Western sanctions as well as Ukraine’s long-range attacks is putting pressure on the Russian oil industry.

Others are reading now

Western sanctions as well as Ukraine’s long-range attacks is putting pressure on the Russian oil industry.

What is happening?

Russia is facing a deepening fuel crisis as wholesale gasoline production has dropped sharply since the start of 2025.

Daily output plummes

According to the Russian news outlet Kommersant, daily output has fallen by 17.3%, from an average of 123,600 tons in January to just 102,200 tons by mid-August.

This decline has triggered a surge in gasoline prices across the country.

Prices spike

Fuel prices have soared in tandem with the production slump.

Also read

The Moscow Times reported on August 18 that the national index for AI-92 gasoline—comparable to regular unleaded—climbed to 71,500 rubles (around $890) per ton. AI-95, the premium variant, shot up to 80,430 rubles (approximately $1,000) per ton.

These prices rose by 1.3% and 2.2% respectively in just one day.

Year-to-Date increases paint a stark picture

The year-on-year figures are even more alarming.

Since January 2025, AI-92 gasoline prices have surged nearly 38%, while AI-95 has risen a staggering 49%.

Kremlin extends export ban to curb rising prices

In an attempt to stabilize the market, the Kremlin extended its temporary ban on gasoline exports.

Also read

As of August 14, the ban now lasts through September 2025 for producers and through October for non-producers.

The move is designed to boost domestic supply and ease price pressure—at least in the short term.

Experts point to drone strikes and sanctions

Kommersant reports that energy experts attribute the production shortfall to a mix of unscheduled refinery shutdowns and lengthy repair times.

Ukrainian long-range drone strikes have likely contributed to the disruptions.

In addition, Western sanctions have restricted access to essential equipment, complicating maintenance work.

Also read

Sanctions complicate refinery maintenance

A source in the oil sector told Kommersant that repairing refineries—especially those using foreign-made equipment—can take months.

Scheduled maintenance has already been delayed due to limited access to parts, further straining operations.

Authorities are bracing for additional outages, with as many as 10 major refineries expected to undergo maintenance this fall.

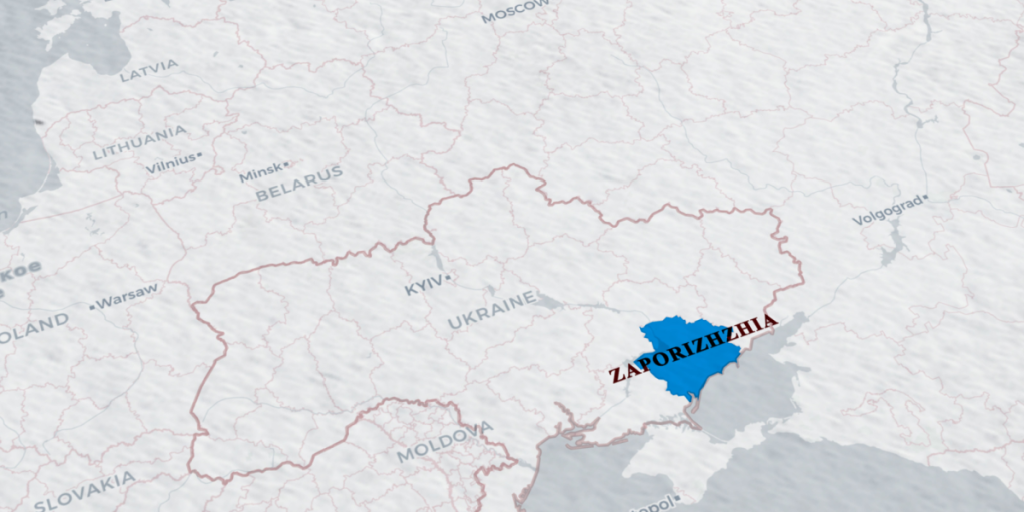

Spread across Russia and occupied regions

Several regions are already experiencing fuel shortages, including areas of occupied Ukraine.

Crimea’s Russian-appointed leader Sergey Aksyonov told Kommersant that AI-95 gasoline is in particularly short supply, citing low production and transport challenges due to vulnerable road routes.

Also read

Occupied Zaporizhia faces critical disruptions

In occupied Zaporizhia Oblast, AI-92 and AI-95 gasoline are becoming increasingly scarce.

The region’s Kremlin-installed head, Yevgeny Balitsky, blamed the shortage on the risk of Ukrainian attacks against fuel-carrying trains, which has disrupted delivery routes.

War effort tied to oil revenue

Russia’s reliance on oil revenue to finance its war in Ukraine underscores the urgency of the crisis.

The fuel shortfall not only affects daily life but also raises questions about Moscow’s ability to sustain its military campaign while under severe economic pressure from the West.

Undermines Kremlin’s narrative

This latest energy crisis undercuts the Kremlin’s long-standing claim that Russia can weather Western sanctions and continue funding the war indefinitely.

Also read

As internal issues mount, the gap between rhetoric and reality is becoming harder to ignore.