The EV startup once hailed as a “Tesla Killer” has taken a dramatic turn—losing over 96% of its value and scrambling to stay listed on the stock market.

Others are reading now

The EV startup once hailed as a “Tesla Killer” has taken a dramatic turn—losing over 96% of its value and scrambling to stay listed on the stock market.

From Darling to Desperate

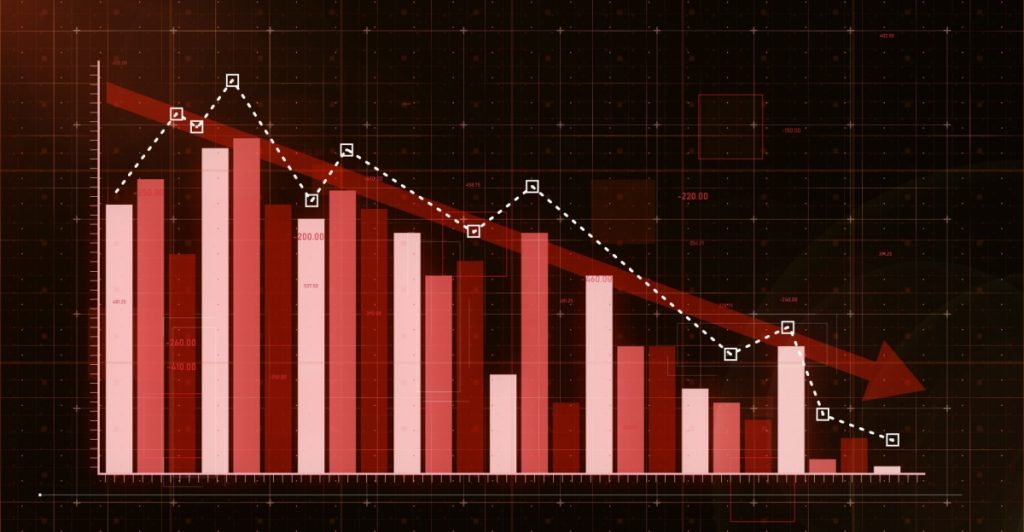

Lucid Motors was once a Wall Street favorite, peaking at $64.86 per share in 2021. But last week, shares dipped below $2—forcing the company to initiate a rare 10-to-1 reverse stock split to avoid being delisted from NASDAQ.

What Is a Reverse Stock Split?

A 10-to-1 reverse split means investors now hold one share worth 10 times more, but with fewer total shares in circulation. This is often seen as a red flag, suggesting further price declines ahead.

The Dream That Was Lucid Air

Lucid’s flagship sedan, the Air, boasted up to 1,234 horsepower, 0–100 km/h in 2.5 seconds, and over 800 km of range—rivaling or surpassing Tesla’s Model S. But real-world traction has lagged far behind.

Lofty Goals, Harsh Reality

Lucid aimed to build 90,000 cars by 2024. In reality, they delivered just over 10,000. Meanwhile, Tesla rolled out nearly 1.8 million EVs in the same year.

Also read

Massive Losses Per Car

Despite $808M in revenue last year, Lucid lost $3.1 billion—translating to an eye-watering $299,000 loss for every vehicle sold.

Shrinking Market Confidence

Once expected to be a $100B company, Lucid’s market cap now sits around $6.4B—only five times its projected 2025 sales. For context, Tesla’s value still exceeds $1T.

Cost Cuts and Challenges

Lucid has slashed Air prices by nearly $9,000, but high production costs limit their flexibility. Analysts remain skeptical about the company’s path to profitability.

A Broader EV Slowdown?

Lucid’s woes also reflect wider concerns: softening EV demand, intensifying competition, and ballooning manufacturing costs. Even industry giants are feeling the squeeze.