recent years have brought persistent challenges, and the turnaround momentum has faded.

Others are reading now

After 11 years at the helm, Target CEO Brian Cornell is stepping down amid declining sales and mounting pressures. The leadership change will take effect on February 1, 2026, with Michael Fiddelke,

Target’s current COO and a 20-year veteran of the company, set to take over. While some analysts pushed for an external hire to shake things up, Target opted for a familiar face.

From Turnaround Hero to Tough Times

Cornell joined Target in 2014 and led a major transformation of the brand. Under his leadership, the retailer remodeled stores and strengthened its digital capabilities to better compete with Amazon.

But recent years have brought persistent challenges, and the turnaround momentum has faded.

A Deepening Sales Slump

Target reported falling sales for the third consecutive quarter, and the news hit investors hard, shares tumbled 8% in premarket trading.

Also read

With its stock now among the worst performers in the S&P 500 this year, the company is facing renewed scrutiny over its strategy and direction.

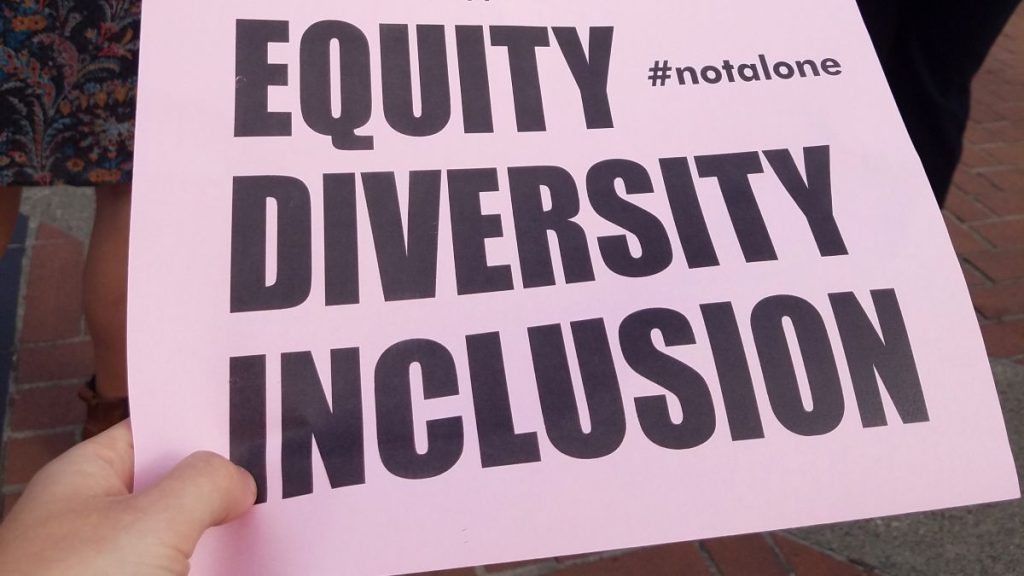

Controversy Over DEI Pullback

In 2025, Target drew widespread backlash after rolling back some of its diversity, equity, and inclusion (DEI) programs.

The move disappointed customers and even sparked criticism from within the founding Dayton family, with two heirs calling it “a betrayal.” Target later admitted the backlash had hurt sales.

More Than a PR Problem

Unlike other companies, Target had made DEI a key part of its brand identity, making its retreat all the more jarring.

With a largely progressive customer base, the decision triggered online protests and eroded brand loyalty, at a time when the company could least afford it.

Also read

Struggling with Consumer Shifts

Target’s focus on trendy, nonessential products has left it vulnerable. As consumers tighten their belts, they’re spending more on necessities and less on home décor and apparel, categories where Target once thrived.

By contrast, Walmart’s strength in groceries has helped it weather the shift.

Tariffs Add to the Pressure

Target’s supply chain is another weak spot. About half of its products are imported, far more than Walmart’s 33%, making it more sensitive to tariff hikes.

To cover rising costs, Target has had to raise prices at nearly double the pace of Walmart, further weakening its competitiveness.