Has the Russian economy hit a technical stagnation? Not according to Putin.

Others are reading now

Has the Russian economy hit a technical stagnation? Not according to Putin.

What is happening?

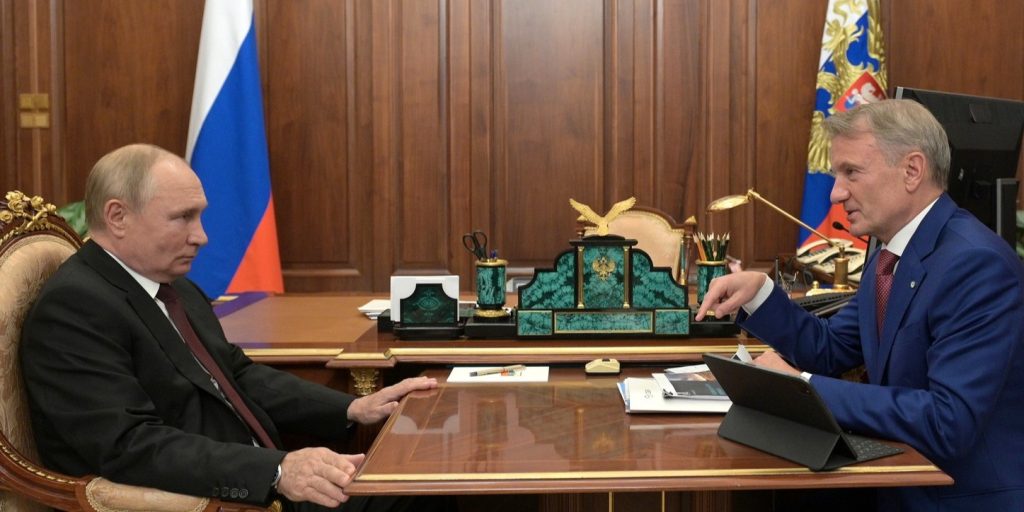

A rare public disagreement has emerged between Vladimir Putin and German Gref, the CEO of Sberbank, Russia’s largest bank.

“Technical stagnation”

Gref warned that the country’s GDP growth had stalled in July and August, describing the second quarter as “technical stagnation.”

Putin, on the other hand, downplayed the concerns, insisting the slowdown reflects a “soft landing.”

“Ask Gref”

At the Eastern Economic Forum, Putin responded directly to Gref’s remarks.

Also read

He argued the economy hasn’t stalled, saying, “Ask Gref. Has lending stopped? No. The pace has just slowed.”

The sharp exchange highlighted Putin’s effort to downplay the economic toll of the war in Ukraine.

A window into Russia’s war-weary economy

Experts say this clash exposes more than a policy disagreement—it reveals the hidden strain of the war on Russia’s economy. Sluggish growth, inflation pressures, and growing government spending have all left a deep mark.

The gap between Kremlin narratives and institutional data is widening.

German Gref walking a tightrope

German Gref is one of Russia’s most influential bankers.

Also read

As CEO of Sberbank, he’s under pressure to remain loyal while delivering the truth.

Analysts suggest his comments were measured, possibly out of concern for retaliation by Russia’s powerful security services.

“Cautious speech to avoid FSB scrutiny”

Ukrainian economist Oleh Pendzin believes Gref’s careful tone may reflect fears of drawing attention from the FSB, Russia’s successor to the KGB.

“You can see how cautiously Gref speaks,” Pendzin said. “Public discussion is the only way today for economists to convey this problem to Russia’s top leadership.”

Russia cuts interest rates

In another sign of economic stress, the Bank of Russia recently cut its key interest rate by one percentage point, bringing it down to 17%.

Also read

The move comes as military spending balloons and growth continues to slow, squeezing the federal budget.

Inflation still a major concern

While inflation eased slightly in July and August, the central bank says it remains at 8.2%.

Officials warned that inflation expectations remain high, which could prevent further progress.

“This may impede a sustainable slowdown in inflation,” the bank noted.

Business frustration grows over rate hikes

Previously, the central bank had raised rates to 21% in a bid to curb inflation.

Also read

But the sharp hikes drew backlash from business leaders and lawmakers who argued they were stifling economic activity.

The recent rate cut signals an attempt to ease that pressure.