The U.S. president hints China could be next in line for steep trade penalties due to its oil purchases from Russia.

Others are reading now

President Donald Trump signaled on August 6 that China may soon face new U.S. tariffs due to its continued purchase of oil from Russia.

According to the White House, the oil purchase is helping finance the Kremlin’s war in Ukraine.

Timeline Unknown

“It could happen… I can’t say [exactly] yet,” Trump told Reuters reporters.

“We’ve done it with India. We’ll probably do it with a couple more countries. China could be one of them.”

Hitting India Hard

The announcement came just hours after Trump signed an executive order imposing an additional 25% tariff on Indian goods, doubling the previously announced duties to a total of 50%.

Also read

Trump cited India’s large-scale oil purchases from Russia as the reason for the penalty.

The new Indian tariffs will take effect in 21 days, unless Moscow halts its aggression in Ukraine.

Targeting Russia’s Oil Revenue—Through Its Customers

The strategy marks a new phase in Trump’s efforts to pressure Russia, not just directly through sanctions but indirectly by targeting its key trading partners.

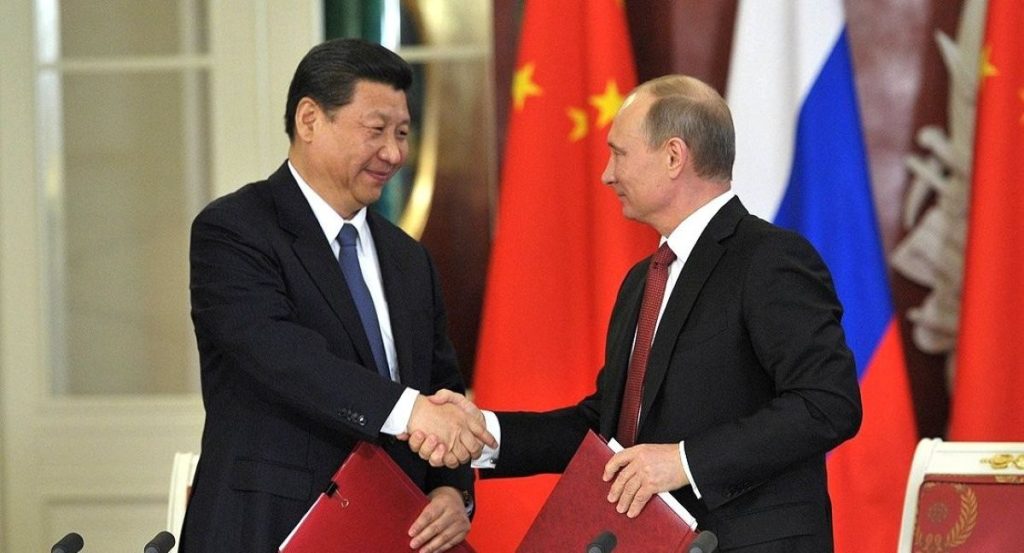

Trump’s special envoy, Steve Witkoff, was recently in Moscow for talks with Russian President Vladimir Putin, trying to broker a peace agreement ahead of the August 8 ultimatum previously announced by Trump.

Meanwhile, U.S. Treasury Secretary Scott Bessent confirmed last week that new tariffs on China are being discussed, should it continue buying oil from Moscow.

Also read

Russia’s Top Oil Buyer

After the start of Russia’s invasion of Ukraine in 2022, China became the world’s largest buyer of Russian oil, filling the gap left by Europe and the U.S.

According to Chinese customs data, China now imports about 2 million barrels per day from Russia—40% of Russia’s total oil exports.

Most of this oil comes via the Skovorodino-Mohe and Atasu-Alashankou pipelines, while the rest is delivered by sea, particularly the ESPO Blend and Sokol grades from Russia’s Far East.

Potential Fallout

If Trump proceeds with additional tariffs, they would add to already steep trade duties imposed during his first term, which have significantly reduced China’s exports to the U.S. in recent months, Bloomberg noted.

Any new move would likely prompt retaliatory measures from Beijing, further escalating economic tensions between the world’s two largest economies.

Also read

India and Turkey Also in the Spotlight

India, the second-largest buyer of Russian oil at around 1.8 million barrels per day, is already facing the consequences of its trade.

Turkey, which imports approximately 400,000 barrels per day, may also face scrutiny as Trump continues his effort to cut off Russia’s war funding at the source.

What’s Next?

With the August 8 deadline looming and no signs of a ceasefire in Ukraine, Trump is expected to increase pressure on Russia and its economic partners, potentially triggering a global trade shift that could reshape diplomatic ties well beyond energy markets.