He’s also seeing a potential dept crisis on the horizon because of Trump’s policies.

Others are reading now

He’s also seeing a potential dept crisis on the horizon because of Trump’s policies.

What is happening?

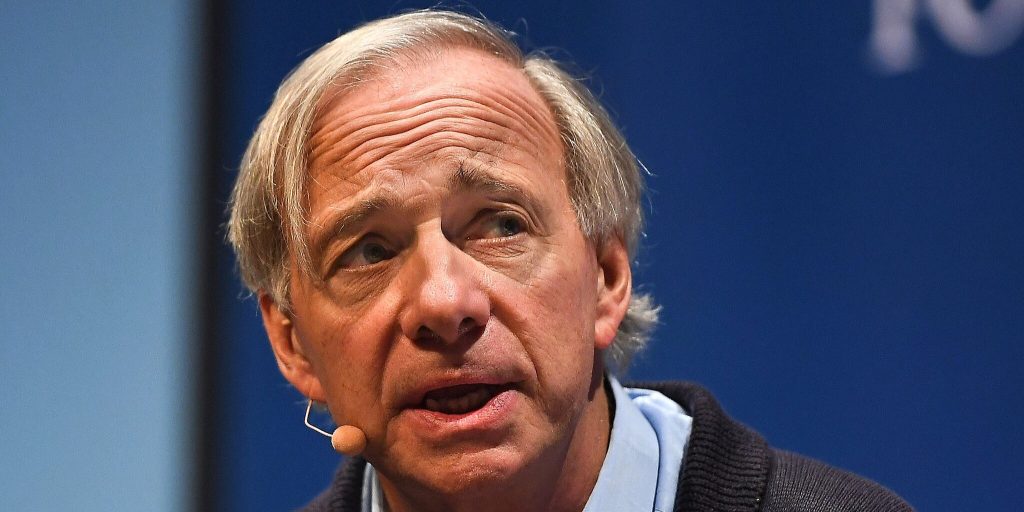

Billionaire investor Ray Dalio has drawn a stark comparison between today’s U.S. political climate and the troubling rise of autocratic regimes in the 1930s.

Speaking to Financial Times, the Bridgewater Associates founder warned that America is edging dangerously close to a similar path—driven by inequality, distrust, and centralized power.

Trump’s policies mirror historical power grabs, says Dalio

Dalio pointed to Donald Trump’s aggressive approach to government intervention in the economy, including the U.S. taking a 10% stake in Intel, as evidence of a shift toward authoritarian leadership.

He argues these moves stem from a desire to control financial outcomes, echoing the economic nationalism of pre-WWII governments.

Also read

Fear of retaliation looms

According to Dalio, many investors and financial leaders are afraid to speak out against the US president.

“In times like these, most people remain silent because they are afraid of retaliation,” he said, highlighting a climate of fear that stifles open criticism and debate.

Bridgewater’s founder breaks ranks

Ray Dalio stands out as one of the few major U.S. investors publicly challenging Trump’s economic direction.

Despite the risk, he’s openly criticized what he sees as a dangerous erosion of democratic norms, amplified by political polarization and growing economic disparity.

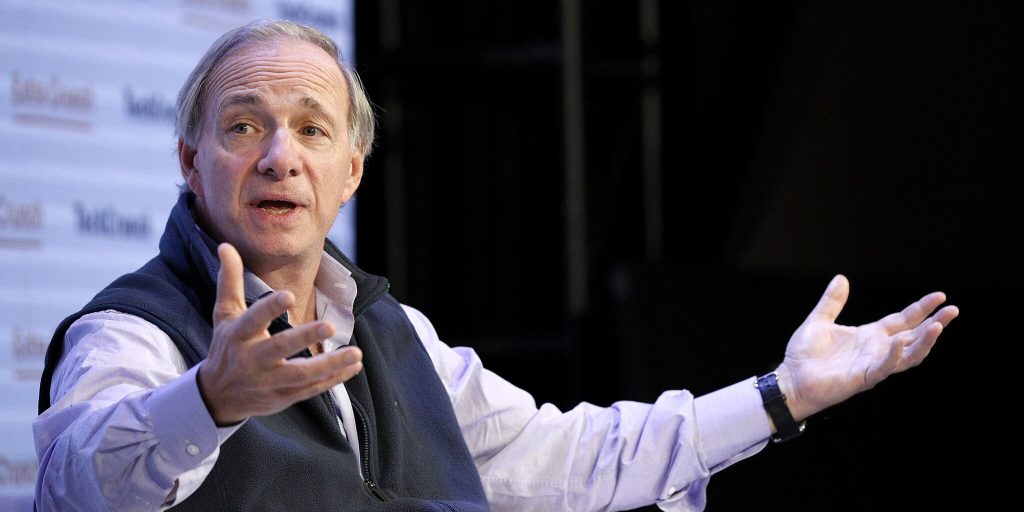

Democracy under strain, autocracy on the rise

Dalio believes that widening wealth gaps and a breakdown in shared values are fueling political extremes on both the left and right.

Also read

These divides, he warns, may no longer be reconcilable through the democratic process—a trend that weakens democracies and fosters support for more authoritarian rule.

A troubling move against the federal reserve

In another example of creeping autocracy, Dalio cited Trump’s attempt to dismiss a female governor from the Federal Reserve—an unprecedented move that threatens the independence of America’s central bank and undermines its role in stabilizing the economy.

A debt crisis on the horizon?

Looking ahead, Dalio is deeply concerned about the long-term consequences of Trump’s fiscal policies.

He warns that the massive spending and growing budget deficits will likely trigger a debt crisis within the next three years, give or take a year or two.

America’s monetary order at risk

Trump’s economic strategy, Dalio argues, could eventually destabilize the very system that underpins global financial stability.

Also read

With “big excesses” mounting from new budgets, he suggests the current monetary order may not survive the coming pressure.

Populism is surging from both sides

Dalio sees a global rise in populism as both a symptom and a cause of democratic erosion.

As people lose faith in democratic processes, many are turning to leaders who promise to take control and “make things work”—even if it means bypassing traditional checks and balances.

“Extreme” policies are becoming the norm

Summing up his warning, Dalio emphasized that today’s extreme political and economic measures are being normalized by deep-rooted societal issues.

Without serious reform, he believes the U.S. could continue down a path that more closely resembles autocratic governance than democratic tradition.