Who actually ran a strong economy, and who didn’t?

Others are reading now

We look past slogans to the numbers: growth, jobs, inflation, and how quickly each White House responded to shocks.

How Were They Ranked

The scorecard leans on official data (BEA/BLS/FRED), NBER recession dates, and OMB budget tables, with the 1970s Great Inflation as essential context.

With that yardstick, here’s the sweep from worst to best — and how each president met the economic moment.

22. Herbert Hoover (1929–33)

Hoover inherited a frothy, debt-laden economy and then watched it collapse into the Great Depression.

His instincts, voluntary wage agreements, balanced budgets, and limited relief, couldn’t match the scale of the crisis or a banking system in free fall.

Also read

Output cratered and joblessness soared, leaving his successors to rebuild from the wreckage in the 1930s.

21. Donald Trump (2017–21)

The pre-2020 economy looked steady, low unemployment, tame inflation, but the COVID shock defined his term.

The recession that the NBER dates from February to April 2020 was the shortest on record but extraordinarily deep, erasing years of job gains and leaving net employment down by Inauguration Day 2021.

Pandemic relief did cushion incomes, but the whiplash set the stage for the volatile recovery that followed.

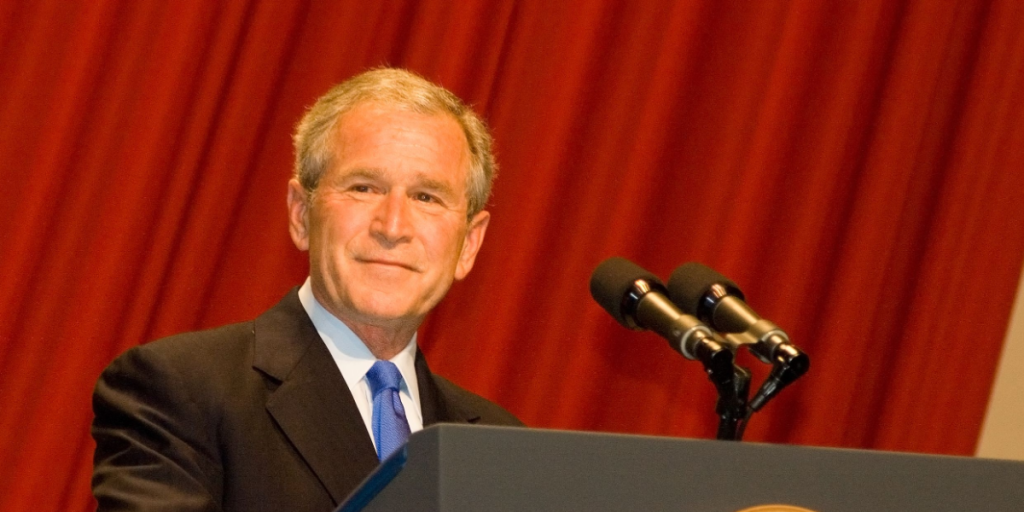

20. George W. Bush (2001–09)

Two bookend downturns, first the 2001 tech-bust recession, then the 2007–09 financial crisis, pinned overall performance near the bottom.

Also read

Tax cuts and a housing-driven expansion carried the middle years, but weak productivity and the crash’s severity produced soft job and income gains over the full term.

The financial rescue stabilized the system but couldn’t salvage the decade’s macro record.

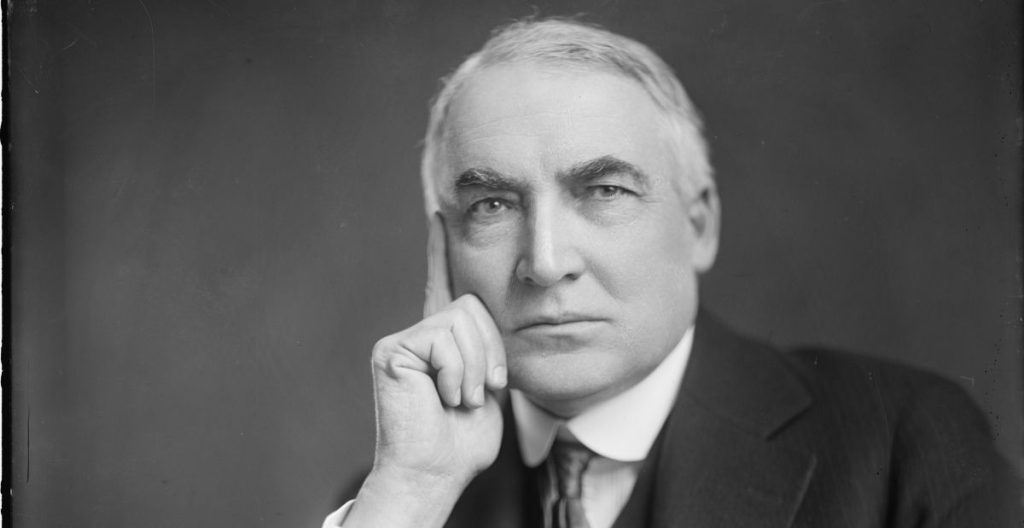

19. Warren G. Harding (1921–23)

Harding’s brief term coincided with the snap-back from the severe 1920–21 depression.

The economy did rebound quickly, aided by falling prices and pent-up demand, but his short tenure and the Teapot Dome scandal overshadowed any emerging agenda.

The recovery’s real acceleration arrived under his successor.

Also read

18. George H. W. Bush (1989–93)

A mild 1990–91 recession, a savings-and-loan clean-up, and war in the Persian Gulf framed a cautious presidency.

He cut a deficit deal that helped long-run fiscal consolidation but presided over a sluggish early-’90s recovery that never felt robust to voters.

The handoff came just as the expansion was gathering speed.

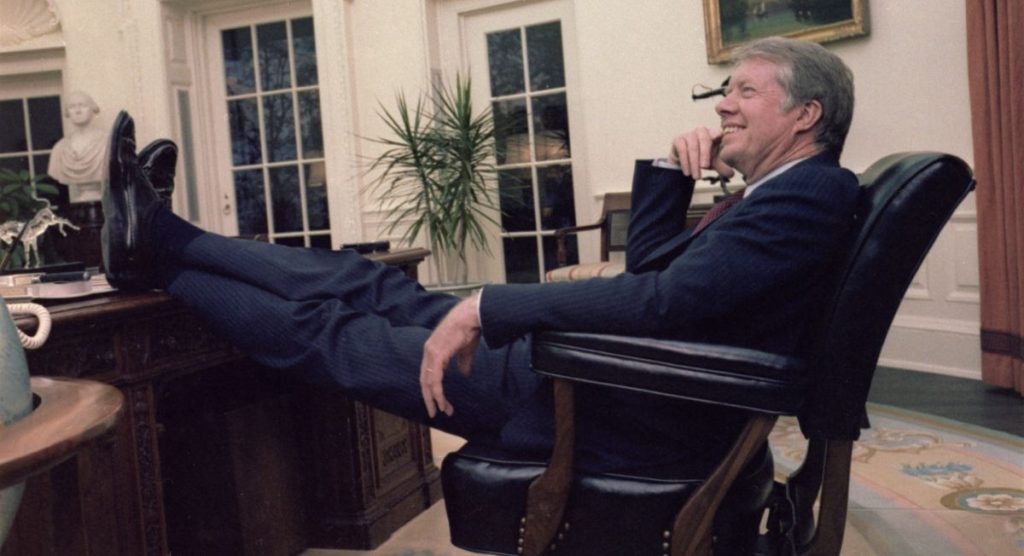

17. Jimmy Carter (1977–81)

Carter’s years produced strong headline job creation and big energy investments, yet inflation and interest rates surged to painful highs.

Oil shocks, productivity woes, and a credibility gap at the Fed fed what became known as the Great Inflation, a legacy that demanded harsh medicine early in the 1980s.

Also read

16. Gerald Ford (1974–77)

Taking office mid-Watergate and mid-recession, Ford rode a 1975 rebound but couldn’t stamp out inflation or high unemployment.

“Whip Inflation Now” buttons didn’t substitute for a coherent disinflation framework, and the stop-go feel of the 1970s economy persisted through his short tenure.

15. Richard Nixon (1969–74)

Nixon broke the dollar’s link to gold and imposed wage-price controls, bold moves that couldn’t prevent stagflation as the decade wore on.

Growth slowed, prices accelerated, and the policy mix (including political pressure on the Fed) left the economy brittle going into the mid-’70s slump.

The seeds of the 1970s inflation were firmly planted.

Also read

14. William Howard Taft (1909–13)

Taft presided over a mixed stretch: a recession in 1910–11 interrupted otherwise decent Progressive-era growth.

Trust-busting advanced, railroad rates were regulated, and the civil service expanded, but the macro record looks middling, neither a breakthrough nor a disaster, between Theodore Roosevelt’s dynamism and Wilson’s wartime upheaval.

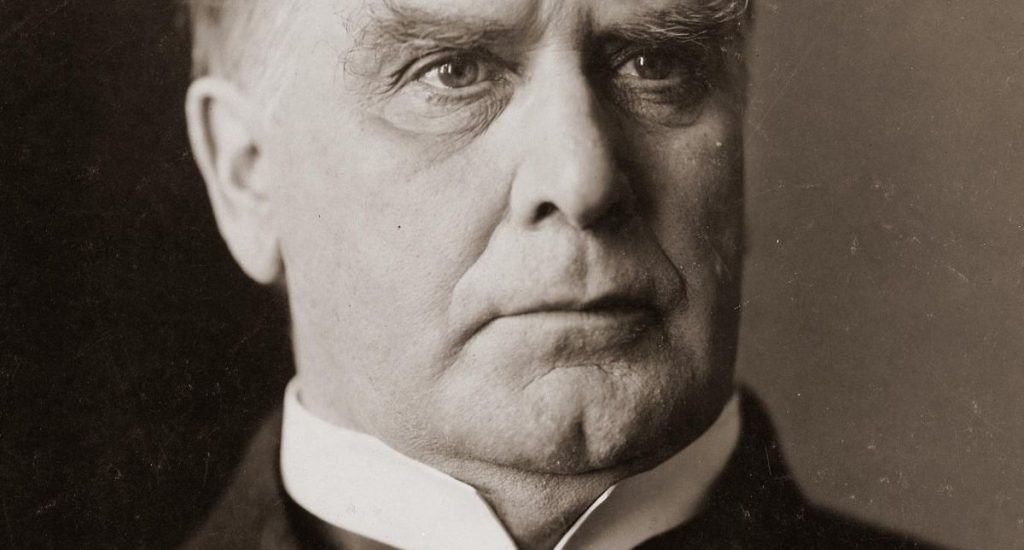

13. William McKinley (1897–1901)

The country emerged from the brutal 1890s depression into a gold-standard era of rising industrial output.

McKinley rode that recovery and a burst of confidence after victory in the Spanish-American War.

He didn’t engineer the upswing so much as he presided over it, stability and tariff policy helping business investment to normalize.

Also read

12. Woodrow Wilson (1913–21)

Wilson’s second term was consumed by World War I. Mobilization spurred production but also stoked very high inflation; the hard 1920–21 adjustment began as he departed.

The creation of the Federal Reserve (1913) proved pivotal for the century ahead, but the near-term macro scorecard is scarred by wartime price spikes and postwar contraction.

11. Harry S. Truman (1945–53)

From V-J Day reconversion to Korea, Truman’s economy had everything: a burst of pent-up demand, a 1949 recession, and an inflation spike as price controls came off.

By the early 1950s, growth had steadied and the foundations of America’s mid-century industrial might, housing, highways, GI Bill-educated workers, were set.

10. Calvin Coolidge (1923–29)

“Silent Cal” presided over the Roaring ’20s: brisk productivity, surging electrification, and very low average inflation.

Also read

Laissez-faire instincts kept the federal footprint light and balanced budgets were a point of pride; the reckoning for leverage and speculation came after he left office. (The good times were real, so were the excesses.)

9. Joe Biden (2021–25)

Biden took office amid the pandemic’s long tail: supply snarls, labor churn, and an incomplete reopening.

A rapid jobs rebound, industrial-policy bets (infrastructure, chips, clean energy), and a manufacturing upturn defined the early recovery; inflation spiked in 2022 then decelerated through 2023 and beyond, while debate persists over the size and timing of stimulus

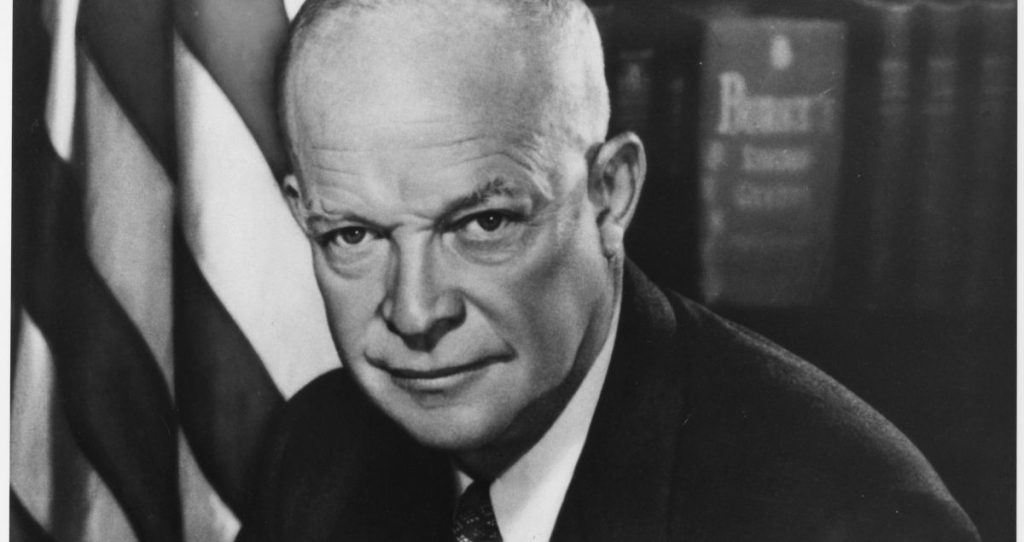

8. Dwight D. Eisenhower (1953–61)

The 1950s were prosperous yet punctuated by short recessions.

Ike governed with a fiscal-prudence bent, balancing growth with price stability, building the Interstate Highway System, and keeping a cool hand on Cold War spending.

Also read

The result was a steadier, lower-inflation expansion than the decade that followed.

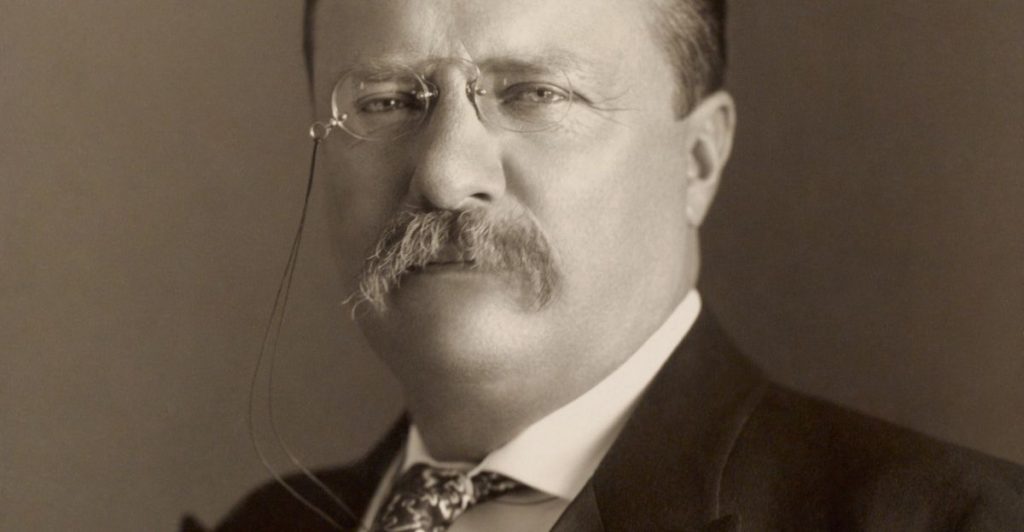

7. Theodore Roosevelt (1901–09)

TR’s “Square Deal” married antitrust activism with conservation and a modern administrative state.

The country industrialized at breakneck speed, and he leaned into reforms to keep markets competitive.

Growth was strong, the national capacity expanded, and the United States entered the 20th century as a confident economic power.

6. Barack Obama (2009–17)

Obama inherited the deepest downturn since the 1930s.

Also read

The Recovery Act, auto rescue, Dodd-Frank, and a long era of near-zero rates under an independent Fed underpinned a slow-then-steady expansion that ran without a recession for the rest of his presidency, unemployment falling, inflation contained, even if wage gains took time to arrive.

5. John F. Kennedy (1961–63)

A short, buoyant presidency: tax-cut momentum, a push for investment and scientific ambition, and a Federal Reserve willing to guide the recovery produced strong growth with tame inflation.

The baton he passed, especially the 1964 tax cut, carried the mid-’60s boom forward.

4. Ronald Reagan (1981–89)

Reagan’s first act was pain: the Fed’s sharp disinflation triggered a deep 1981–82 recession.

Then came a long expansion fueled by lower inflation, tax reform, and deregulation, alongside much larger federal deficits that defined the era’s fiscal politics.

Also read

The trade-off: faster growth but a marked deterioration in the budget balance.

3. Lyndon B. Johnson (1963–69)

LBJ presided over the apex of postwar prosperity: powerful growth, very low unemployment, and historic investments in human capital via the Great Society.

Late-term inflation pressures began to build as Vietnam spending rose, but the economy of the mid-’60s remains a high-water mark for broad-based gains.

2. Franklin D. Roosevelt (1933–45)

FDR took office with the banking system on its knees; within days, he stabilized it.

The New Deal didn’t end the Depression alone, but it moved demand, re-employed millions, and modernized finance; then wartime mobilization unleashed extraordinary growth.

Also read

Over his full tenure, real output rose dramatically, albeit in an utterly unique emergency context.

1. Bill Clinton (1993–2001)

Clinton’s 1990s were a virtuous cycle: the tech boom, NAFTA/WTO-era trade, productivity acceleration, and disciplined budgets together produced strong growth, low unemployment, and low inflation.

The capstone was four straight unified-budget surpluses (FY 1998–2001), a late-20th-century rarity that still stands out in the historical tables.