Spain’s car industry, one of Europe’s biggest exporters, is under mounting strain. Weaker demand in its main European markets and the surge of Chinese automakers have cut exports by nearly 9% so far in 2025.

Others are reading now

Spain’s car industry, one of Europe’s biggest exporters, is under mounting strain. Weaker demand in its main European markets and the surge of Chinese automakers have cut exports by nearly 9% so far in 2025.

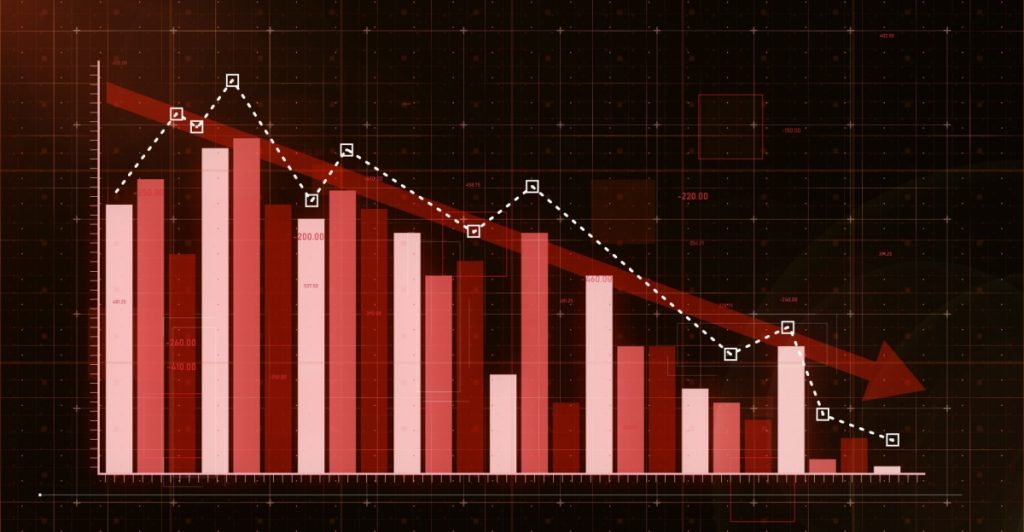

Exports Drop Sharply in First Half of 2025

Spanish automakers exported €25.66 billion worth of vehicles in the first six months of 2025, down 8.9% year-on-year. The decline has slashed the sector’s trade surplus by more than half, to just €2.14 billion.

Europe’s Demand Slumps

Key markets are cooling. Spanish car sales to Germany fell 4.7%, to France 7.9%, and to Italy 3.6%. The weaker demand forced Spanish factories to cut production by more than 111,000 vehicles compared with last year.

Trade Surplus Shrinks by 55%

Car and motorcycle manufacturers saw their export surplus contract by 41.2%, to €4.8 billion. Meanwhile, imports grew 13.4% to €14 billion, eroding Spain’s once solid automotive trade balance.

Stellantis, Renault, Volkswagen Most Exposed

Spain’s 18 car factories are dominated by Stellantis, Renault, and Volkswagen. Nearly 90% of all vehicles made in Spain are exported, making the industry highly vulnerable to global market shifts.

Also read

Chinese Brands Gain Ground

Despite Chery’s entry into the Spanish market with a new plant in Barcelona’s Free Trade Zone, overall exports fell 10.8%. Analysts warn that growing Chinese competition in Europe is squeezing sales of Spanish-built models.

Passenger Cars Hardest Hit

Of the 1.04 million vehicles exported in the first half of 2025, passenger cars saw the steepest fall—down 12.6%. Commercial and industrial vehicles declined by 3.3%, reflecting weaker business demand.

Suppliers Face Tariff Pressures

Component makers, too, are under strain. Although they cut their trade deficit by 20% to €2.66 billion, U.S. tariffs on automotive products indirectly hurt them. Parts exported to Germany are often assembled into cars bound for America, where demand has fallen.

Sector Still Vital for Spain’s Economy

The automotive industry represents 13% of Spain’s exports and 10.6% of imports. Even with the downturn, it remains one of the country’s most strategic sectors, though its weight in trade is now under pressure.

Calls for Stronger Measures Ahead

Industry groups are urging the government to act, warning that without support Spain risks losing ground in the global automotive race. With Chinese brands rising and U.S. tariffs weighing, Spain’s carmakers face a defining crossroads.