A major investment agreement between Japan and the U.S. is now on hold.

Others are reading now

A high-stakes investment agreement between Tokyo and Washington is on pause, with Japan’s lead negotiator abruptly cancelling his trip.

Last-Minute Cancellation

Japan’s top trade official, Ryosei Akazawa, was expected in Washington this week to finalize a $550 billion investment package, part of a broader agreement aimed at reducing US tariffs on Japanese imports.

But the trip was abruptly cancelled, leaving US officials and global markets wondering what’s holding up the deal.

Japan Speaks Out

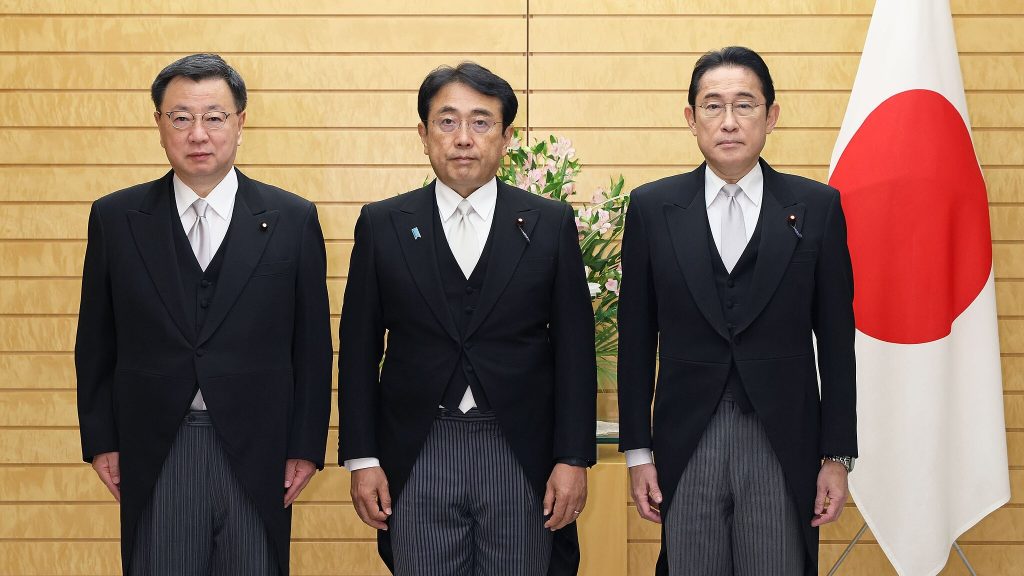

According to Japanese government spokesman Yoshimasa Hayashi, unresolved issues surfaced at the administrative level during coordination with US counterparts, prompting the last-minute decision.

“It was found that there were points that needed to be discussed at the administrative level,” Hayashi explained during a Thursday briefing.

Also read

What’s in the Deal?

The deal, first outlined in July, promises a 15% tariff cap on Japanese imports in exchange for a sweeping investment package.

The funding would be largely driven by government-backed Japanese loans and guarantees. It is meant to stimulate the US economy, particularly in key sectors like tech and manufacturing.

Japan: Legal Guarantees or No Deal

US Commerce Secretary Howard Lutnick hinted earlier this week that a formal announcement was imminent.

But Tokyo is seeking firm legal guarantees before proceeding.

At the heart of the disagreement: executive orders issued by President Donald Trump, including one on reciprocal tariffs, which Japan says could result in double taxation on certain products.

Also read

Auto Tariffs

Another flashpoint is automobiles.

The US currently imposes a 27.5% tariff on Japanese cars. Under the new agreement, that would drop to 15%, though no timeline has been confirmed.

“We strongly urge that measures to amend the presidential order on reciprocal tariffs be taken as soon as possible,” said Hayashi. He also called for a separate executive order to lower tariffs on auto parts.

The 90% Profit Claim

Adding to the tension is Trump’s recent claim that the US would retain 90% of the profits from Japan’s investment.

This is something Japanese officials have firmly reject, insisting the investments must benefit both economies.

Also read

Economic Pressure on Japan

Tokyo has reason to tread carefully.

Exports to the US have fallen, and July marked the steepest drop in four years, contributing to Japan’s decision to cut its 2025 GDP growth forecast from 1.2% to just 0.7%.

The economic impact of ongoing US tariffs, especially on automobiles and beef, has deepened the urgency for Japan to secure clear terms before signing off on any major financial commitment.

What’s Next?

Despite the delay, talks are expected to resume soon.

One government source told Reuters that Akazawa may head to Washington as early as next week, if remaining issues can be resolved.