Nvidia’s latest earnings run has intensified the debate over whether the AI boom is overheating or only just beginning.

Others are reading now

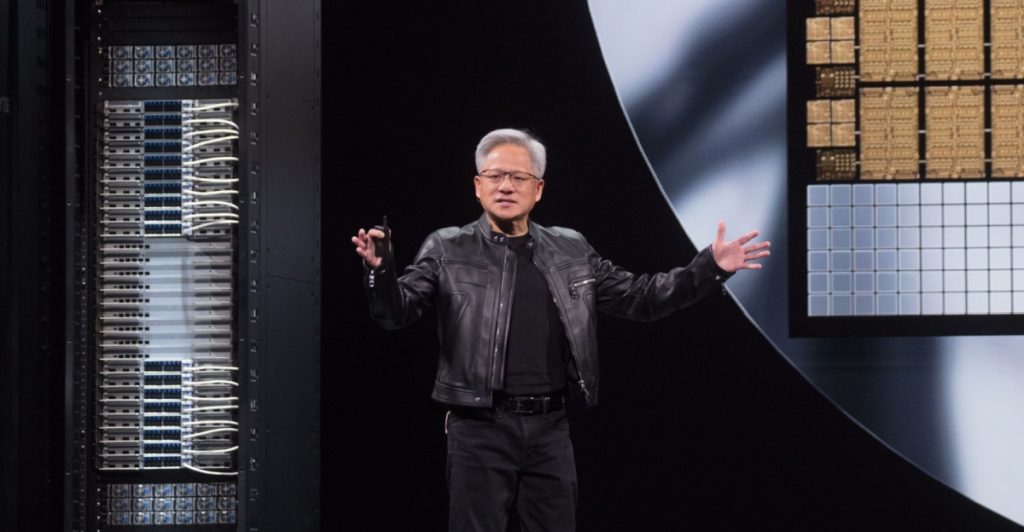

Nvidia’s latest earnings run has intensified the debate over whether the AI boom is overheating or only just beginning. While investors fret over sky-high valuations and “circular” financing, CEO Jensen Huang insists the world is in the middle of a fundamental computing shift — one that Nvidia is uniquely positioned to lead.

The results he unveiled this week offered powerful ammunition for his case.

Record-breaking quarter

Nvidia posted $57 billion in third-quarter revenue, soaring past expectations and climbing 62% from a year earlier, according to Fortune and the Associated Press. Data-center sales — the backbone of Nvidia’s AI business — hit $51.2 billion, up 66% year-over-year as demand for the company’s Blackwell GPUs continued to outstrip supply.

Shares rose as much as 5.7% in after-hours trading following the announcement.

Huang said the adoption of Blackwell chips by hyperscalers such as Microsoft, Meta, OpenAI and Google is progressing at unprecedented speed. “Blackwell sales are off the charts, and cloud GPUs are sold out,” he said.

Also read

CFO Colette Kress told analysts the company now sees $3 trillion to $4 trillion in annual AI-infrastructure spending by the end of the decade — a staggering figure that she said reflects “significant visibility” into upcoming chip orders.

‘We see something very different’

Despite market jitters and multiple analysts warning of an AI asset bubble, Huang waved off the concerns.

“There’s been a lot of talk about an AI bubble,” he told investors. “From our vantage point, we see something very different.”

Huang argued the world is undergoing three simultaneous platform shifts — the first such convergence since the early days of Moore’s Law:

- Accelerated computing, replacing general-purpose servers

- Generative AI, transforming search, recommendations, advertising and moderation

- Agentic AI, capable of planning, reasoning and coding

“Nvidia is unlike any other accelerator,” Huang said, noting that virtually all major players in these transitions — including OpenAI, Anthropic, xAI, Google and Tesla — run their models on Nvidia hardware.

Also read

Earlier earnings underscore the trajectory

Nvidia’s path to this quarter’s numbers was laid out across earlier results, including its second-quarter fiscal 2026 filing. In that period, the company reported $46.7 billion in revenue, up 56% from the previous year, with data-center revenue of $41.1 billion.

Blackwell data-center revenue alone rose 17% sequentially, according to the company’s August filing on Nvidianews.com. Gross margins exceeded 72%, even after adjusting for a one-time H20 inventory release. There were no H20 sales to China — a trend that continued into subsequent quarters as export controls tightened.

Huang described Blackwell as “the AI platform the world has been waiting for,” adding that demand for Blackwell Ultra was already “extraordinary.”

China roadblocks remain

Kress acknowledged that U.S. export rules have sharply limited Nvidia’s ability to sell its most advanced GPUs in China. The company assumed zero China data-center revenue for the current quarter, a position unchanged from earlier in the year. Even a modified H20 chip remains snarled in geopolitical uncertainty.

Still, Kress argued that Nvidia must remain the preferred platform for developers globally, “including those in China,” for the U.S. to maintain leadership in AI.

Also read

Investment web raises questions

Nvidia’s expanding network of strategic investments has drawn scrutiny, with some investors warning about “circular” spending loops. Recent filings show holdings of:

- $3.3 billion in cloud provider CoreWeave

- $177 million in Applied Digital

- Major positions in ARM and Nebius

- Smaller stakes in Recursion Pharmaceuticals and autonomous-driving firm WeRide

This week’s announcement that Nvidia and Microsoft will invest up to $10 billion and $5 billion respectively in Anthropic — which will in turn purchase $30 billion of Azure compute — added fuel to that debate.

Huang dismissed concerns, calling the companies “once-in-a-generation partners.” The deals, he said, ensure Nvidia’s hardware powers the most advanced AI models. “We’re expanding the reach of our ecosystem,” he told analysts.

The race accelerates

Despite broader market unease, Huang said the sector’s rapid expansion is no illusion: “We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast—with more foundation-model makers, more startups, more industries, and more countries.”

“The AI race is on,” he added, “and Blackwell is the platform at its center.”

Also read

Sources: Nvidianews, Fortune, The Associated Press