Soaring AI data center demand is diverting memory production toward high-bandwidth chips, triggering sharp DRAM price increases and raising concerns of a prolonged global supply crunch.

Others are reading now

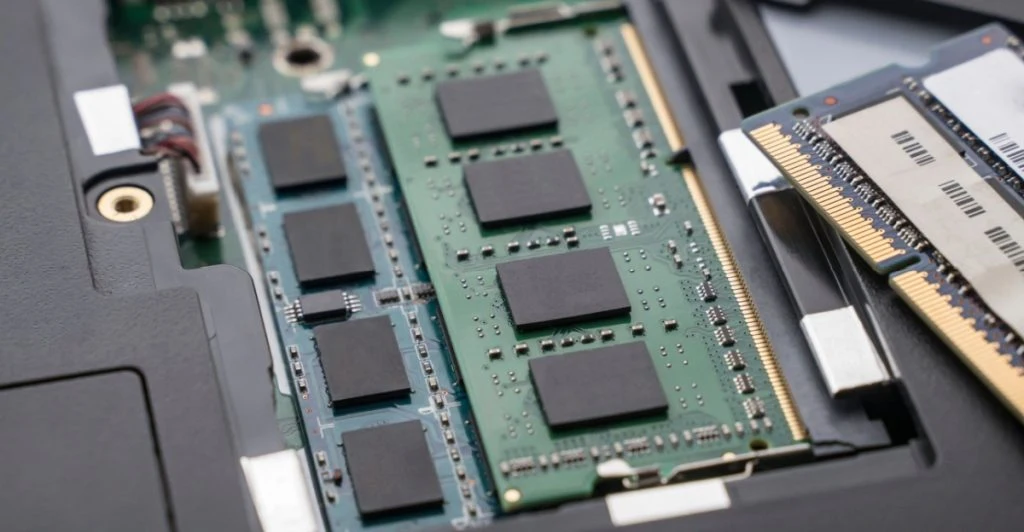

A fresh supply shock is rippling through the technology sector as artificial intelligence devours the world’s memory chips.

Industry leaders warn the squeeze is beginning to hit profits, delay product launches and push prices sharply higher — with no quick fix in sight.

Executives from companies including Tesla and Apple have flagged tightening supplies of DRAM, the dynamic random access memory chips used in nearly all electronic devices. Apple CEO Tim Cook cautioned the shortage would weigh on iPhone margins, while Micron Technology described the bottleneck as “unprecedented.”

“We’ve got two choices: hit the chip wall or make a fab,” Elon Musk said in late January, suggesting Tesla may need to build its own fabrication plant.

AI data center surge

The underlying driver is the explosive buildout of AI data centers. Hyperscalers such as Alphabet, Microsoft, Amazon and Meta are buying vast numbers of Nvidia AI accelerators, each packed with high-bandwidth memory, or HBM — advanced DRAM stacked in multiple layers.

Also read

Nvidia’s latest Blackwell chips contain 192 gigabytes of RAM, while a full NVL72 server system includes 13.4 terabytes. Each rack consumes enough memory to match hundreds of high-end PCs or around a thousand smartphones.

TrendForce estimates demand for HBM will jump 70% in 2026, with the technology accounting for 23% of total DRAM wafer output, up from 19% last year.

Prices surge

As manufacturers including Samsung, SK Hynix and Micron redirect production toward AI-focused memory, supply for traditional electronics has tightened sharply.

One type of DRAM rose 75% between December and January, prompting some retailers to adjust prices daily. Lenovo CEO Yang Yuanqing said the imbalance “is not simply a short-term fluctuation” and could last through the year.

UBS and Bernstein analysts have warned that capital expenditure plans by hyperscalers — expected to exceed $650 billion in 2026 — are straining the entire semiconductor supply chain.

Also read

Wider fallout

The impact is spreading. Sony is reportedly considering delaying its next PlayStation release, while Nintendo is said to be weighing price increases. Chinese smartphone makers have trimmed shipment forecasts, and Cisco cited the memory crunch in issuing a weaker profit outlook.

“DRAM shortages are set to persist across the electronics, telecom, and automotive industries throughout the year,” said Counterpoint analyst MS Hwang.

Micron executive Manish Bhatia called the situation “the most significant disconnect between demand and supply” he has seen in 25 years.

For now, chipmakers are benefiting from higher margins. But for consumers and manufacturers alike, the AI-fuelled race is driving up costs — and reviving fears of another prolonged semiconductor crisis.

Sources: Bloomberg; TrendForce; Counterpoint Research; UBS; Bernstein; company statements