Amid a government crackdown on steep discounting, BYD predicts many electric vehicle makers won’t survive—reshaping China’s EV landscape entirely.

Others are reading now

Amid a government crackdown on steep discounting, BYD predicts many electric vehicle makers won’t survive—reshaping China’s EV landscape entirely.

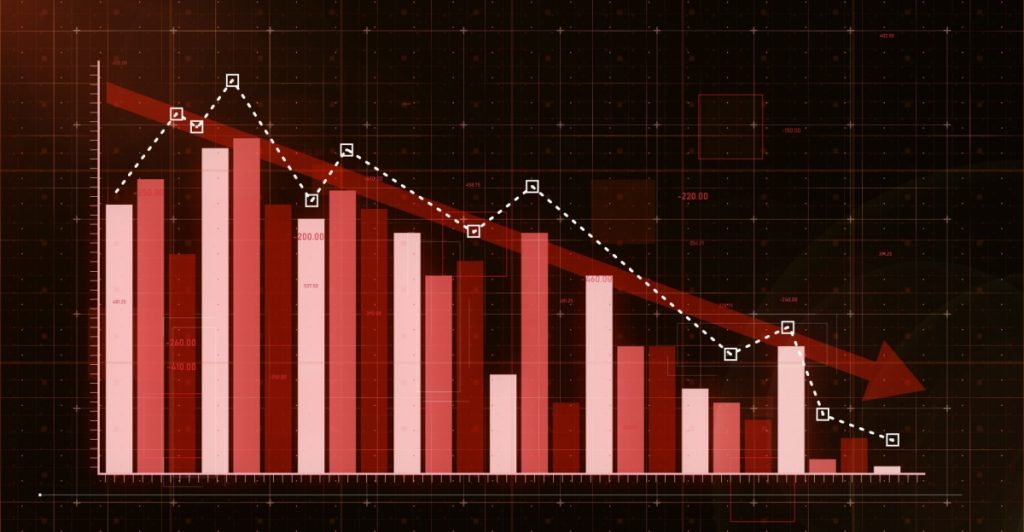

Discount Wars Have a Price

The government is targeting EV companies that cut prices aggressively to win sales—claiming such practices drive unsustainable deflation in the industry.

BYD Calls Out Excess Producers

According to BYD’s exec Stella Li, too many EV makers are chasing market share. She believes that among the 129 OEMs in China, only around 15 will be financially viable in the next five years.

“Even 20 is Too Much”

Stella Li said that even having 20 OEMs competing may be too many. Many small manufacturers are expected to be pushed out without stronger financial foundations.

Comparing Giants and Upstarts

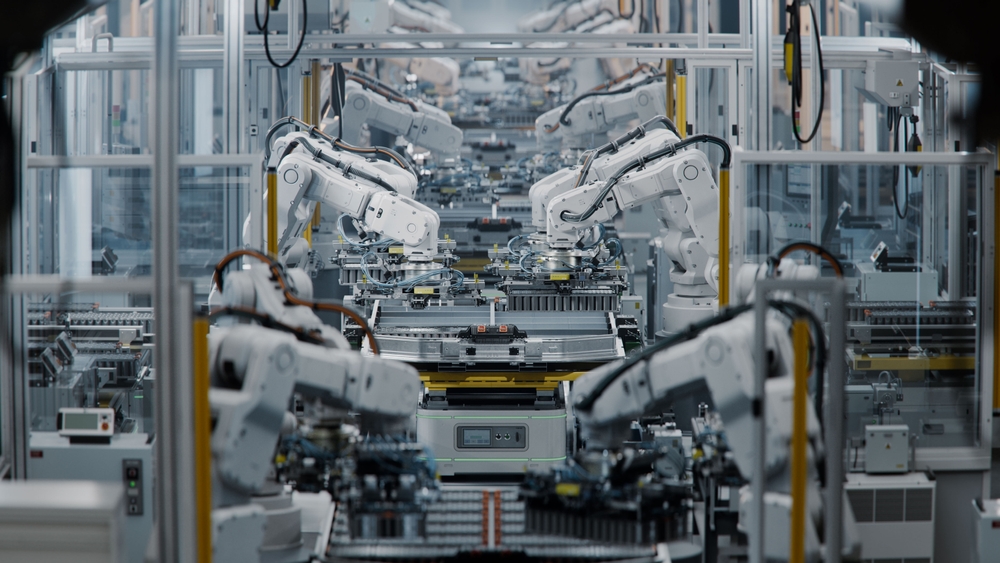

BYD, in contrast, has seen massive growth—especially in the UK—while many smaller OEMs are struggling to keep up with production costs and market expectations.

Also read

BYD on Track to Beat Tesla in Europe

BYD has closed the sales gap with Tesla in Europe this year. If current trends hold, it might overtake Tesla in the region by year-end.

UK as a Key Battleground

In the UK, BYD’s mix of five models and aggressive growth has helped it surge in registrations, challenging Tesla’s dominance locally.

Survival of the Fittest Begins

Consultants believe only a select few OEMs will endure. Many small manufacturers without strong backing or efficiency will disappear.

Industry Reset Coming

With regulatory pressure, competition, and cost challenges mounting, China’s EV sector appears headed for consolidation—fewer players, but hopefully stronger ones.