New probes this week could serve as the foundation for even broader future tariffs.

Others are reading now

New probes this week could serve as the foundation for even broader future tariffs.

What is happening?

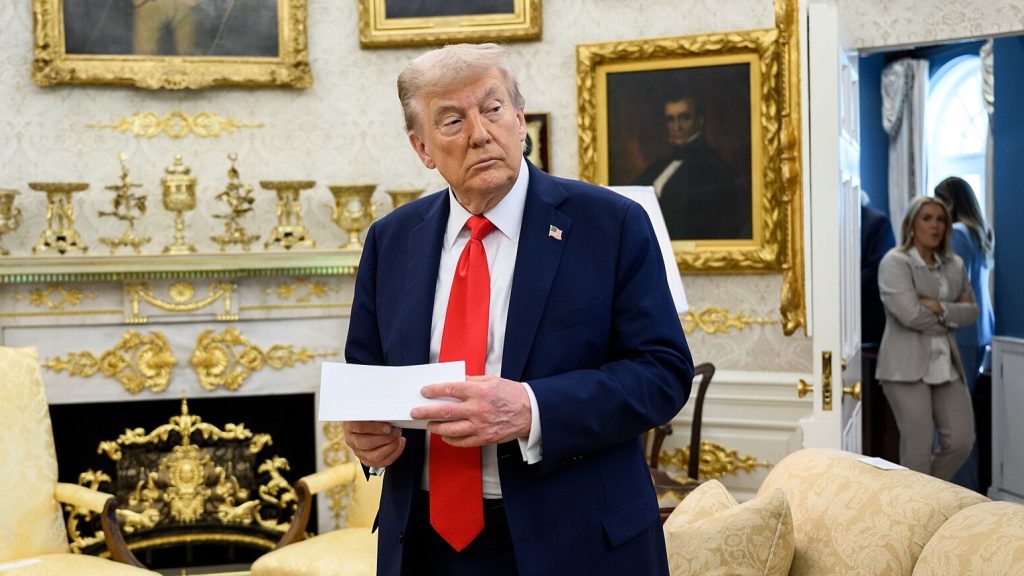

US President Donald Trump has rolled out a major new round of tariffs, targeting a wide range of imports.

Starting October 1, branded pharmaceuticals will face a 100% tariff, and heavy-duty trucks will be hit with a 25% levy, while furniture is also getting slapped.

National security

Trump says the measures are essential to defending U.S. industry and national security—continuing his pattern of using trade policy as a political and economic weapon.

Pharmaceuticals take the biggest hit

The new drug tariffs will apply to all branded or patented pharmaceutical imports, unless the manufacturer has already begun building a production facility in the U.S.

Also read

Trump framed the move as a push to localize drug manufacturing. However, industry leaders warned the tariffs could jeopardize billions in planned investments, potentially disrupting drug supply chains and increasing consumer costs.

Pharma stocks plunge in Asia market

The announcement rocked Asian markets, with Australia’s CSL falling to a six-year low.

Japan’s Sumitomo Pharma sank over 3%, and major pharmaceutical indices in Hong Kong and India dropped more than 1%.

The tariff threat introduces fresh uncertainty into an already volatile global pharmaceutical sector, particularly for exporters that rely heavily on U.S. markets.

Tariffs on furniture aim to revive U.S. jobs

Trump also made good on a promise to bring back the American furniture industry.

Also read

New duties include 50% tariffs on kitchen cabinets and vanities, and 30% on upholstered furniture.

In 2024, the U.S. imported $25.5 billion in furniture, with 60% coming from Vietnam and China. Trade groups in Vietnam swiftly criticized the move as “unfair.”

Global trade partners push back

The backlash from U.S. allies was swift. Australia called the tariffs “unfair and unjustified,” while Japan said it was still analyzing the potential impact.

Officials from Tokyo and Canberra have expressed concern over whether the new measures conflict with existing trade agreements.

Tensions are likely to escalate as countries weigh retaliation or legal challenges.

Also read

Existing trade deals may offer some protection

Trump’s announcements notably did not clarify whether the new tariffs will stack atop existing national tariffs.

However, trade agreements with the EU, U.K., and Japan include clauses that cap duties on specific goods.

Japan’s negotiator Ryosei Akazawa said his country’s deal ensures it won’t face harsher tariffs than others, though he declined to comment directly on the new measures.

Truck tariffs put pressure on allies—and prices

The 25% tariff on heavy-duty trucks could hit U.S. partners hard. Mexico, Canada, Japan, Germany, and Finland are among the top exporters.

Mexico warned that its trucks already contain roughly 50% U.S. parts, including engines.

Also read

The U.S. Chamber of Commerce called on the administration to drop the tariffs, citing unnecessary strain on key alliances and supply chains.

American truckmakers poised to benefit

Trump insists the truck tariffs will support U.S. manufacturers facing “unfair outside competition.”

Companies like Peterbilt, Kenworth (owned by Paccar), and Freightliner (owned by Daimler Truck) could see gains.

However, critics argue the policy risks raising transportation and logistics costs, potentially pushing up prices across the economy—undermining Trump’s anti-inflation promises.

National security as the new legal justification

Facing a pending Supreme Court case that questions the legality of earlier global tariffs, the Trump administration is now basing new actions on national security investigations.

Also read

This strategy provides a more defensible legal basis for broad tariffs, as the White House tries to shield its trade agenda from legal setbacks while ramping up enforcement.

New tariff probes signal more to come

Trump’s administration has launched more than a dozen investigations into imports, including wind turbines, semiconductors, copper, timber, and critical minerals.

New probes this week expanded to cover PPE, robotics, medical equipment, and industrial machinery.

These cases could serve as the foundation for even broader future tariffs, deepening global trade tensions.

Billions in tariff revenue

Despite warnings from economists and industry groups, the Trump team touts tariffs as a key revenue stream.

Also read

Treasury Secretary Scott Bessent claims the U.S. could collect $300 billion in tariff revenue by year’s end.

However, critics argue the real cost is higher prices for consumers and instability for businesses navigating an increasingly unpredictable trade environment.

Can tariffs really bring jobs back?

Trump’s rhetoric focuses on restoring U.S. manufacturing jobs.

But in sectors like furniture and wood products, employment has halved since 2000, down to around 340,000 workers today. Whether tariffs can reverse that trend remains unclear.

For now, they serve more as a political signal—reinforcing Trump’s America First platform ahead of the next election cycle.