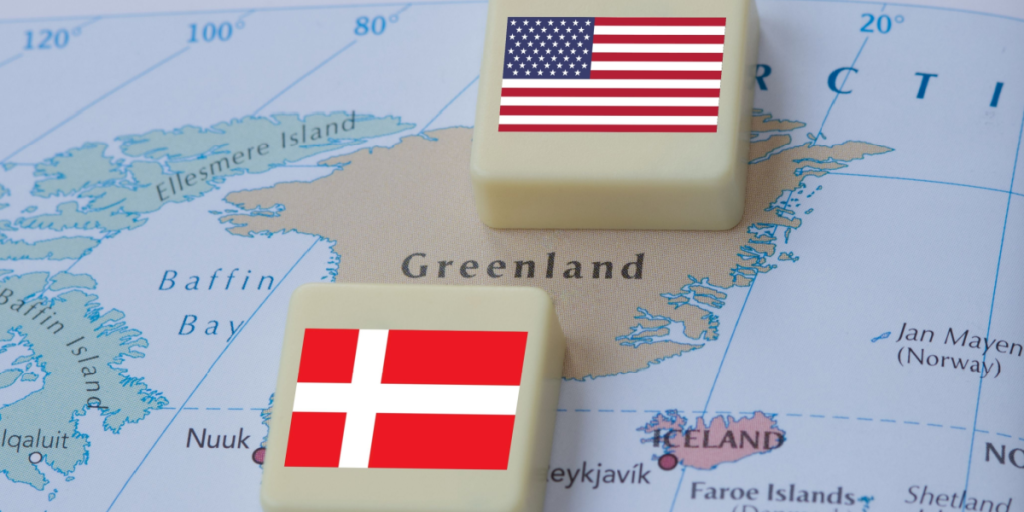

Billionaires quietly back AI-driven mining push in Greenland as geopolitics intensify

Others are reading now

As Washington and Copenhagen trade words over Greenland’s strategic importance, a quieter shift has been taking place far from public view. Some of the world’s most powerful business figures have been positioning themselves around the Arctic island’s vast mineral potential.

The investments point to a parallel race unfolding alongside diplomacy, where private capital is moving ahead of governments.

Early moves

Jeff Bezos, Bill Gates and Michael Bloomberg have all invested in KoBold Metals, an exploration company that uses artificial intelligence to locate critical minerals, Forbes reported. The investments began in 2019, shortly after former US President Donald Trump first floated the idea of buying Greenland.

Sam Altman, the chief executive of OpenAI, joined KoBold’s backers in 2022 through his venture fund. The company searches for minerals such as copper, lithium, nickel and cobalt, which are vital for clean energy technologies and electronics.

KoBold operates dozens of exploration projects worldwide and has partnerships with major mining firms, including BHP and Rio Tinto.

Also read

Political connections

Other investments have raised concerns in Greenland and Denmark. Ronald Lauder, heir to the Estée Lauder fortune, invested in a Greenlandic freshwater bottling company linked to senior local politicians, according to the Danish newspaper Politiken.

John Bolton, Trump’s former national security adviser, told Forbes that Lauder was the businessman who first suggested the idea of the US buying Greenland during Trump’s first term.

Lauder later outlined ways Washington could increase its influence over the island without outright ownership, including deeper cooperation with Denmark and Greenland.

A different vision

Peter Thiel’s involvement comes through Praxis, a startup aiming to build a technologically advanced city on the island. Praxis describes itself as part of the “network state” movement and has promoted the idea of a lightly regulated, high-tech settlement.

The company raised $525 million in 2025 and has held discussions with Greenlandic officials about building on uninhabitable land, according to TechCrunch and The New York Times.

Also read

Why Greenland matters

Greenland holds an estimated 1.5 million metric tons of rare earth reserves, according to the US Geological Survey, placing it among the world’s top holders. These materials are essential for electric vehicles, wind turbines and military equipment.

China currently dominates global supply, a position that has alarmed Western governments after recent export controls. Despite its resources, Greenland has yet to host a commercial rare earth mine, with projects slowed by environmental concerns, political risk and harsh Arctic conditions.