Despite Western bans, a complex re-export network centered in Armenia is helping Russian diamonds glitter abroad again.

Others are reading now

Despite strict Western sanctions, Russian diamonds are making their way into the global jewelry trade—by passing through Armenia and emerging with their origins obscured.

This was reported by The Moscow Times.

Sanctioned, but Still Sparkling

Efforts by the G7 and European Union to block Russian diamonds from entering Western markets have been quietly undermined.

A joint investigation by the Organized Crime and Corruption Reporting Project (OCCRP) and several European media outlets reveals that Russian diamonds continue to reach Europe and the United States, with Armenia emerging as a key transit point.

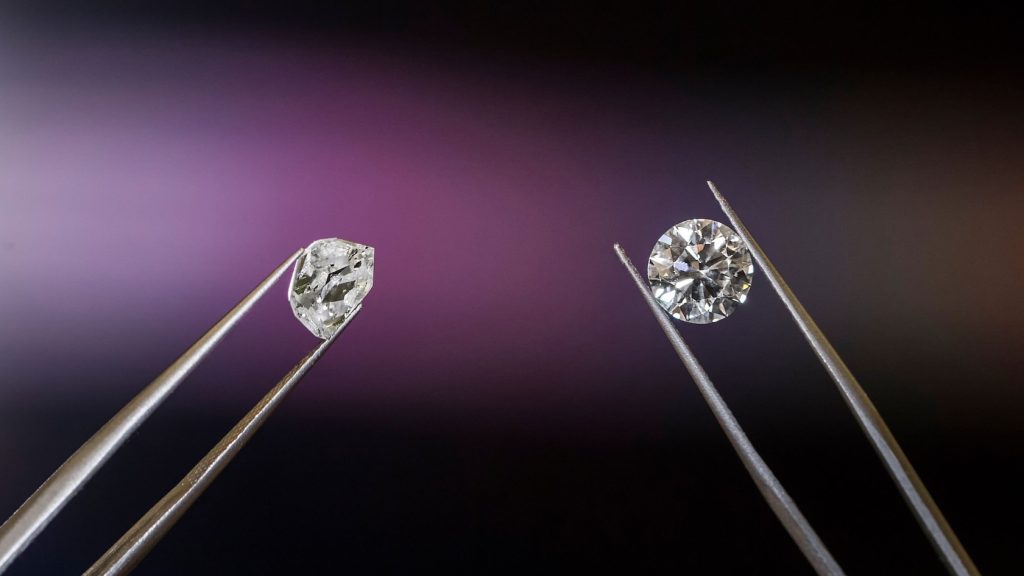

The challenge lies in traceability. Once diamonds are cut and polished, their country of origin becomes nearly impossible to verify, leaving the door open for circumvention.

Also read

A Quiet Re-Export Giant

In the wake of sanctions imposed on Alrosa, Russia’s state-owned diamond producer, new businesses were quickly established to move around the restrictions.

Chief among them was First Diamond Company (FDC), founded in May 2022 with leadership closely tied to Alrosa’s former employees.

FDC exported more than $290 million worth of diamonds to Armenia between January 2023 and March 2024, according to OCCRP data.

These stones, reprocessed in Armenia, were then re-exported under new labels to global destinations—stripping them of their Russian identity.

Where the Diamonds Go

Once reprocessed, Armenian exports of Russian-origin diamonds flow through India, the United Arab Emirates, and onward to Western markets.

Also read

The journey provides plausible deniability for companies and countries that wish to maintain business ties without openly violating sanctions.

KGK Group

India’s KGK Group, long a titan in the global gem trade, previously had open ties with Alrosa.

Though such references vanished from the company’s public materials after Russia’s 2022 invasion of Ukraine, the connections appear far from severed.

FDC’s largest trading partner, Imperial Diamond, is tied to Ramani Vitalbhai Vallabhbhai, an Indian-born Russian citizen with links to KGK.

Other intermediaries with similarly murky affiliations—Gloria Gems Trading and Mohit Diamonds—handle billions of dollars in trade, much of which eventually enters the U.S. and EU markets.

Also read

How Russian Gems Disappear into Global Supply Chains

Once diamonds are polished and re-exported, their paper trail can be manipulated or lost.

European officials admit they often lack the technical means to identify where a diamond was originally mined.

As a result, customs agents and importers may unknowingly be dealing in sanctioned stones.

Shadow Companies Filling Alrosa’s Vacuum

In addition to FDC, two other companies — Trading Horizons and Diamond Trading House (DTH) — were formed to maintain Russia’s export routes.

Like FDC, they’re run by ex-Alrosa personnel and pass revenues back to Alrosa through agency arrangements.

Also read

DTH alone has inked over $330 million in contracts with Enso Global Trading, according to 2024 filings. These firms are essential cogs in Russia’s shadow export machine, helping Alrosa stay afloat in spite of restrictions.

Sanctions vs. Supply Chains

These revelations have the vulnerabilities of sanctions in industries like diamond trading, where global supply chains are opaque and origin claims are difficult to verify.

Even with satellite tracking, customs data, and financial disclosures, sanctions enforcement becomes symbolic if end products can be repackaged under legal flags.

European Markets Still at Risk

The Belgian and American jewelry markets continue to see high volumes of diamonds from these channels.

OCCRP’s findings suggest that sanctions enforcement is often limited to declarations, with limited inspection capabilities or third-party verification.

Also read

Calls for Stronger Monitoring and Transparency

With billions at stake and the integrity of sanctions on the line, watchdogs are calling for stronger international cooperation, blockchain-based tracking, and mandatory origin disclosure — reforms that diamond lobby groups have long resisted.

Until such changes are made, loopholes like Armenia’s re-export scheme may remain open.

Political and Diplomatic Implications

Beyond the gem trade, the investigation signals broader geopolitical tensions.

As Russian President Vladimir Putin continues to court nations like Armenia, India, and China, these trade relationships offer both economic oxygen and diplomatic cover.

During a recent meeting, Serbian President Aleksandar Vučić reportedly voiced concern over the escalating fallout from Western sanctions, highlighting the widening global divide over how to handle Moscow’s isolation.