There is some hope for recovery once the shutdown ends. While the immediate impact has been severe, most of the damage is expected to reverse quickly.

Others are reading now

The government shutdown that began on October 1 has become the longest in U.S. history, surpassing the 2018-2019 shutdown that lasted 35 days.

As it continues, experts are warning that this shutdown is not only unprecedented in length but also in its economic impact. The consequences are far-reaching, with lasting harm to the economy and millions of American lives affected by the halt in essential services.

A Historic Shutdown

This current shutdown stands out from previous ones due to its scale and duration. Unlike earlier shutdowns, which affected only specific parts of government operations, this one is impacting 100% of government spending.

The unprecedented length and scope of this shutdown are causing disruptions that the U.S. economy has never fully experienced before, setting a troubling new record in the history of government shutdowns.

Widespread Economic Impact

The shutdown has caused significant economic distress for millions of Americans. One of the most immediate effects has been on those who rely on food stamp benefits, with millions of families now missing these crucial payments.

Also read

At the same time, around 1.4 million federal employees are not receiving pay, even though many continue to work without compensation. These individuals are feeling the economic pressure as they are expected to perform their duties without any income, leading to financial and emotional strain for them and their families.

Uncertainty and Data Blackout

Perhaps one of the most significant impacts of the shutdown is the data blackout it has created. With key government agencies unable to release reports on vital economic indicators such as job numbers, inflation, and consumer spending, policymakers and investors are operating without the necessary information to make informed decisions.

This lack of transparency is contributing to heightened uncertainty in the markets and throughout the economy.

Projected Economic Damage

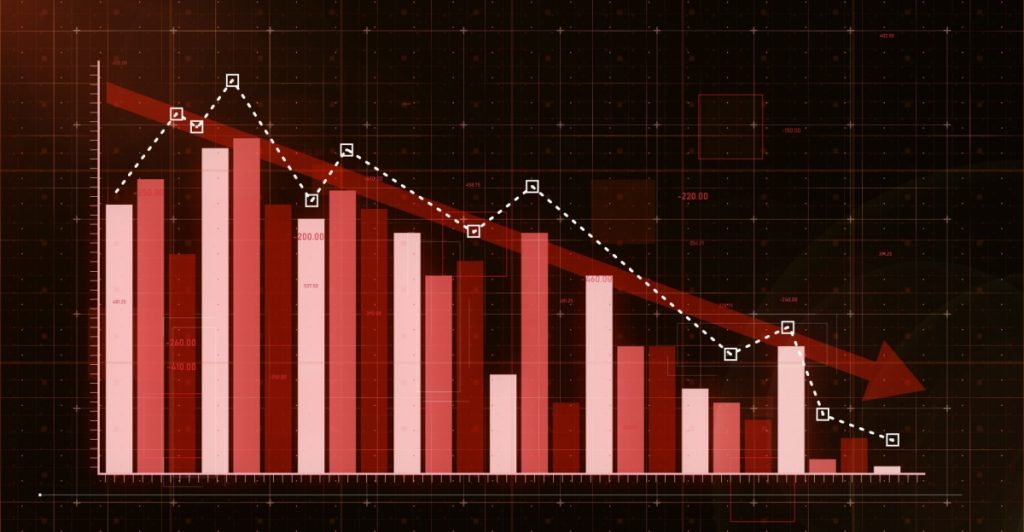

The economic consequences of the shutdown are being felt immediately. Goldman Sachs estimates that the shutdown will reduce the fourth-quarter GDP by 1.15 percentage points. Similarly, the Congressional Budget Office (CBO) has predicted a reduction in GDP of 1 to 2 percentage points.

These declines represent a significant blow to the U.S. economy, with the shutdown causing broader economic ripple effects across various sectors.

Also read

Permanent Economic Losses

While some of the economic damage may be temporary, certain losses are expected to be permanent. According to the CBO, up to $14 billion in economic activity could be permanently lost as a result of the shutdown.

Furloughed federal workers may never recover the wages they’ve lost, and delayed federal spending could have long-term consequences. These losses will be felt even after the government reopens, further compounding the economic challenges facing the nation.

Impact on Economic Growth

The prolonged shutdown is also contributing to a slowdown in overall economic growth. Goldman Sachs has revised its projections, now expecting Q4 GDP growth to fall to just 1%, down from earlier estimates of 3% to 4%.

This reduction in growth underscores the deeper economic challenges the shutdown is creating, including disruption in government services and delays in critical government spending.

Broader Economic Struggles

The shutdown is worsening an already fragile economic landscape. Prior to the shutdown, the economy was already grappling with issues such as high tariffs, reduced immigration, and the return of student debt payments.

Also read

These challenges were slowing economic growth, and the shutdown has only added fuel to the fire. With the government now stalled, the ongoing shutdown is making these existing struggles even more difficult to overcome.

The Data Blackout’s Impact on Policy

With crucial economic data reports sidelined, the shutdown has created a policy-making void. Agencies like the Bureau of Labor Statistics, which typically track key metrics like job numbers and inflation, have been unable to release reports.

This leaves policymakers and the Federal Reserve making decisions without access to the usual data that informs their actions, which increases the risks of policy missteps during such an uncertain time.

Federal Reserve’s Struggle with Limited Data

The Federal Reserve is also facing challenges due to the lack of data. For the first time in history, the Fed had to make decisions about interest rates without access to key reports, such as the monthly jobs report.

Fed Chair Jerome Powell emphasized the difficulty of navigating the economy with limited information, saying, “What do you do if you’re driving in the fog? You slow down.” This uncertainty could delay or change the Fed’s approach to interest rates, further complicating the economic recovery.

Also read

Potential for Economic Rebound

There is some hope for recovery once the shutdown ends. While the immediate impact has been severe, most of the damage is expected to reverse quickly.

Goldman Sachs anticipates a strong rebound in the first quarter of 2026, with GDP growth expected to surge to 3.1% as furloughed workers return to their jobs and delayed federal spending resumes. This recovery is contingent on the government reopening and workers being paid for their lost time.

Long-Term Consequences for the Economy

Although the shutdown’s effects will likely rebound in the long term, there will be lasting consequences.

The CBO estimates that up to $14 billion in economic activity could be permanently lost, with a portion of the damage from furloughed workers never being fully recovered. This underscores the broader, long-term economic toll the shutdown is taking on the country.

A Defining Crisis

The ongoing shutdown is the longest and most damaging in U.S. history. Its effects have rippled through every sector of the economy, leaving millions without pay, stalling key government functions, and creating uncertainty in markets.

Also read

While a recovery is expected once the government reopens, the economic damage will be felt for years to come, and the nation’s ability to avoid future shutdowns will depend on the decisions made in the coming weeks.