Donald Trump’s push to take control of Venezuela’s oil faces an awkward reality: one of the country’s biggest historical customers is moving away from crude far faster than expected.

Others are reading now

Analysts say China’s energy transition is reshaping the geopolitics around Venezuela long before Washington’s strategy can take hold.

Electric surge

China’s rapid adoption of electric vehicles is the main force driving down its long-term demand for oil, experts told CNN.

Of the 18.5 million electric vehicles sold globally last year, more than 11 million were sold in China, according to UK research firm Rho Motion.

The shift has been particularly pronounced in the transport sector, where analysts say oil demand has already peaked.

“This is just very decisive; it’s not going to go back,” said Li Shuo, director of the China climate hub at the Asia Society Policy Institute, pointing to China’s consistent EV policy compared with what he described as uneven progress in the US.

Also read

Shrinking appetite

China has long been one of Venezuela’s most important oil customers, but that reliance is fading.

Energy analysts say China has either already reached peak oil consumption or will do so soon, limiting how much Venezuelan crude it needs even if supplies are disrupted.

That means recent US military action in Venezuela and efforts to revive its oil infrastructure are unlikely to have a major impact on China’s energy security.

US pressure

As CNN has reported, the Trump administration has told Venezuela’s interim president Delcy Rodriguez that the country must cut ties with China, Iran, Russia and Cuba, and instead work exclusively with the US on oil production.

US officials said this week that Washington would sell Venezuela’s oil as part of that strategy.

Also read

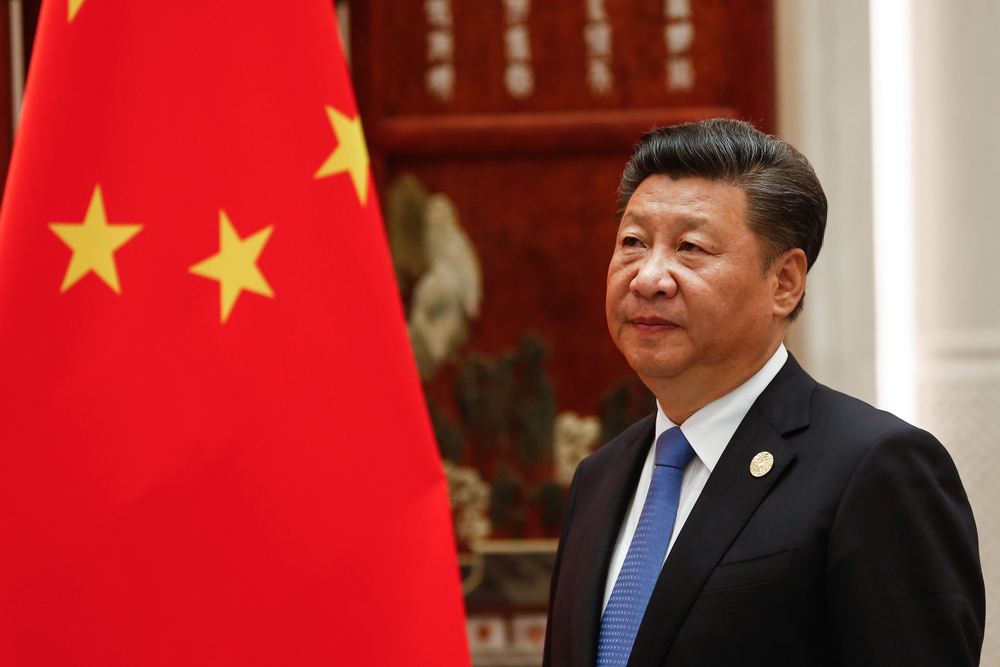

China pushed back strongly. In a statement to CNN, the foreign ministry said cooperation with Venezuela was “legitimate and in line with the interests of both sides” and “not subject to third-party interference”.

Market realities

China is the world’s largest oil importer, so even modest shifts in its demand can ripple across global markets.

About 400,000 to 500,000 barrels per day of Venezuelan oil currently flow to China, according to Janiv Shah, a vice president at Norwegian energy firm Rystad.

He said US intervention could sharply reduce that figure, but added Chinese refiners would likely turn to discounted oil from Iran or Russia instead.

“Venezuela is very much reliant on China as a market,” Shuo said. “There is no question about that.”

Also read

Diverging paths

Experts say the situation highlights a widening divide between Washington and Beijing on energy strategy.

China continues to expand wind, solar, nuclear power and electric transport, while the US is doubling down on oil production at home and abroad.

“The largest economy in the world is embracing a petrostate approach,” Shuo said. “It just reinforces this notion that the United States is increasingly going backward on the energy transition.”

Sources: CNN