The BBB is projected to increase the federal deficit by $3.4 trillion over the next decade.

Others are reading now

The BBB is projected to increase the federal deficit by $3.4 trillion over the next decade.

What is happening?

President Donald Trump is hailing the newly passed legislation as a monumental success, predicting it will become one of the most impactful laws in U.S. history.

But the question is, who stands to benefit from the bill, and who should brace themselves.

Corporate America Celebrates Permanent Tax Breaks

Major business groups like the U.S. Chamber of Commerce are cheering the bill’s revival of key corporate tax breaks from the 2017 Tax Cuts and Jobs Act.

Also read

Companies can once again fully deduct the cost of equipment and research expenses in the year they’re incurred.

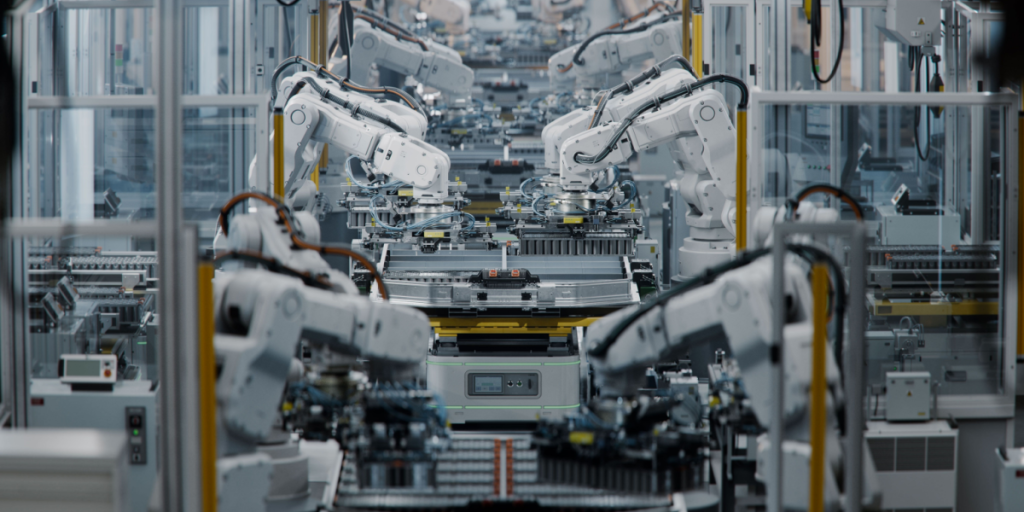

Manufacturers Applaud New Facility Incentives

The bill allows immediate, full deductions for building new manufacturing plants—retroactively from January 2025 through the end of 2028.

It also boosts credits for domestic semiconductor production.

Small Businesses and Partnerships Get a Boost

The legislation locks in a special deduction for owners of pass-through businesses like law firms and medical practices.

Top Earners Gain Thousands Annually

The top 20% of earners could see nearly $13,000 more in annual income, while the top 0.1% may gain over $290,000.

Extra Tax Relief for Tip and Overtime Workers

Through 2028, employees who earn tips can deduct up to $25,000 of that income, and those earning overtime can deduct up to $12,500.

However, these deductions are subject to income thresholds.

Deep Cuts to Safety Net Programs

The bill imposes sweeping cuts to Medicaid and food stamps, including unprecedented work requirements for Medicaid recipients and expanded mandates for SNAP beneficiaries.

Millions Could Lose Health Coverage

According to a Congressional Budget Office analysis, millions may lose Medicaid or Affordable Care Act subsidies.

In total, over 10 million people could be uninsured by 2034 as a result of the legislation.

Low-Income Households Lose Ground

Households earning under $18,000 a year would lose about $165 annually after accounting for benefit cuts—a 1.1% income drop.

Those earning between $18,000 and $53,000 would see only modest gains of around $30 per year.

Middle-Income Gains Are Modest

Middle-income earners—those making between $53,000 and $96,000—are expected to see a $1,430 bump in annual income, translating to a 1.8% increase, mostly due to tax adjustments.

Hospitals Brace for More Uncompensated Care

Hospitals are sounding alarms over Medicaid cuts, warning that reduced funding will spike their uncompensated care burdens.

A $50 billion rural aid fund is included, but health leaders say it falls far short.

Clean Energy Sector Hit by Tax Changes

Despite dodging a last-minute excise tax, the clean energy sector loses vital tax incentives by 2027.

Stricter requirements and reduced credits could stall wind, solar, and renewable projects, the industry warns.

EV Industry Faces Expiring Tax Credits

Electric vehicle manufacturers face a setback, with tax credits of up to $7,500 ending this September—years earlier than the original 2032 expiration.

Deficit Balloons by Trillions

The bill would add an estimated $3.4 trillion to the federal deficit over the next decade, per the Congressional Budget Office.

Soaring Interest Costs May Hit Consumers

With debt costs already surpassing the defense budget, the added deficit could push interest rates even higher.

That means more expensive mortgages, auto loans, and business financing, affecting Americans across the board.