Trump’s Sanctions Rock Russia’s Oil Sector: Fallout, Fears & Future Moves

Others are reading now

Trump’s Sanctions Rock Russia’s Oil Sector: Fallout, Fears & Future Moves

Setting the Stage

Trump Takes Aim at the Kremlin’s Cashflow in a move few saw coming, President Donald Trump has slapped sweeping sanctions on Russia’s top oil giants, marking a sharp shift in his administration’s stance on the Ukraine conflict.

With financial firepower now in play, the geopolitical balance just tilted.

Rosneft and Lukoil in the Crosshairs

According to The Kyiv Independent, the U.S. sanctions freeze American-based assets of Rosneft and Lukoil — Russia’s two largest oil companies.

Together, they account for nearly half of Russia’s crude exports.

Also read

The blacklist also targets over 30 of their subsidiaries, escalating pressure on Russia’s energy industry.

Europe and Asia Feel the Shockwaves

Economist Oleh Pendzin, cited by The Kyiv Independent, explained that sanctions will hit not just the parent companies but their European and global subsidiaries.

s shipping, logistics, and insurance companies withdraw, the operational network around Russian oil is beginning to unravel.

India Pulls Back — A Major Blow

As Bloomberg and The Kyiv Independent report, India — once importing over 2 million barrels per day from Russia — is now slashing purchases.

Indian banks and refineries are backing off, fearing secondary sanctions from Washington. For Moscow, it’s a sharp loss in a key market.

Also read

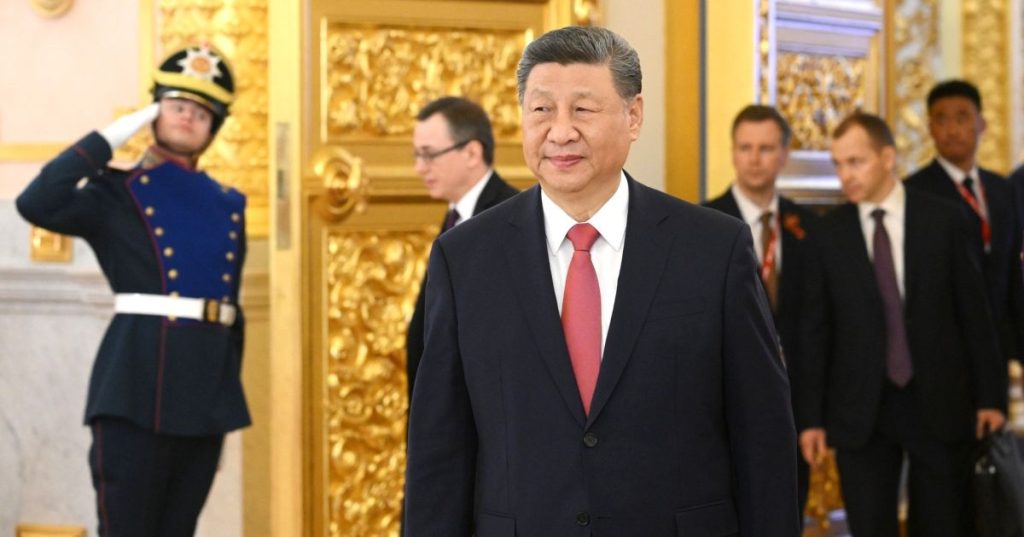

China Hesitates Too

Reuters and The Kyiv Independent note that Chinese state-owned oil firms have suspended seaborne Russian crude purchases, highlighting the ripple effect.

With two of Russia’s biggest buyers stepping back, Moscow’s options grow fewer — and costlier.

Can Russia Dodge the Damage?

According to economist Vasily Astrov, who spoke with The Kyiv Independent, Russia might turn to shell companies and exploit loopholes to keep its exports flowing.

However, banking restrictions and high insurance risks could deter buyers — at least for now.

Will the Sanctions Work?

Oleksandr Talavera, from the University of Birmingham, told The Kyiv Independent that the sanctions may squeeze Russia’s oil profits by raising costs and lowering export tax income.

Also read

But others, like Chatham House’s Timothy Ash, argue the political signal may outweigh the financial impact — unless stronger moves follow.

A Strategy in Motion

While Moscow downplays the impact, the shift in Washington’s posture signals something bigger: a new willingness to strike at the core of Russia’s war funding.

Whether it’s symbolic or substantial, the sanctions have already forced global markets to respond.