Asked whether he was worried about the dollar’s slide, Trump replied, “No, I think it’s great.”

Others are reading now

The US dollar has slumped to its lowest level since February 2022, rattling investors and sending shockwaves through global markets. The latest drop followed remarks from Donald Trump, who shrugged off concerns about the falling currency during a visit to Iowa.

“I think it’s great”: Trump dismisses dollar concerns

Asked whether he was worried about the dollar’s slide, Trump replied, “No, I think it’s great.” He highlighted the strength of US business activity, saying, “The dollar’s doing great,” despite the currency’s sharp drop.

Four-day losing streak rattles investors

Tuesday saw the dollar fall by 1.3% against a basket of major currencies, its biggest one-day drop since last April.

The decline continued into Wednesday, with a further 0.2% dip, marking a four-day slide and stoking investor anxiety.

Dollar down 10% over the past year

The greenback has shed 10% of its value over the past 12 months. Its recent plunge echoes market turbulence last April when Trump’s surprise tariff threats triggered a global sell-off.

Also read

Geopolitical shocks fuel currency decline

Trump’s unpredictable policy moves, such as threats to take over Greenland and ramp up tariffs on European allies, have shaken markets. Analysts say the political instability is adding pressure on the dollar, already weakened by economic uncertainty.

Mixed outlook: weak dollar helps some, hurts others

“A weaker dollar is a two-sided coin,” said Steve Sosnick of Interactive Brokers. While multinational firms may benefit from stronger foreign revenues, consumers could face higher prices on imported goods, potentially stoking inflation.

Swiss franc surges to decade-high

The Swiss franc has gained 3% against the dollar in 2026 alone, after jumping 14% last year. Considered a haven in times of turmoil, the franc is now trading at its highest level against the dollar in over a decade.

Euro climbs to $1.20, strongest since 2025 rally

The euro has also rallied, rising to $1.20 and gaining 2% in just one week. It’s the biggest weekly increase since last April, capping off a strong 2025, when the euro posted its best performance since 2017.

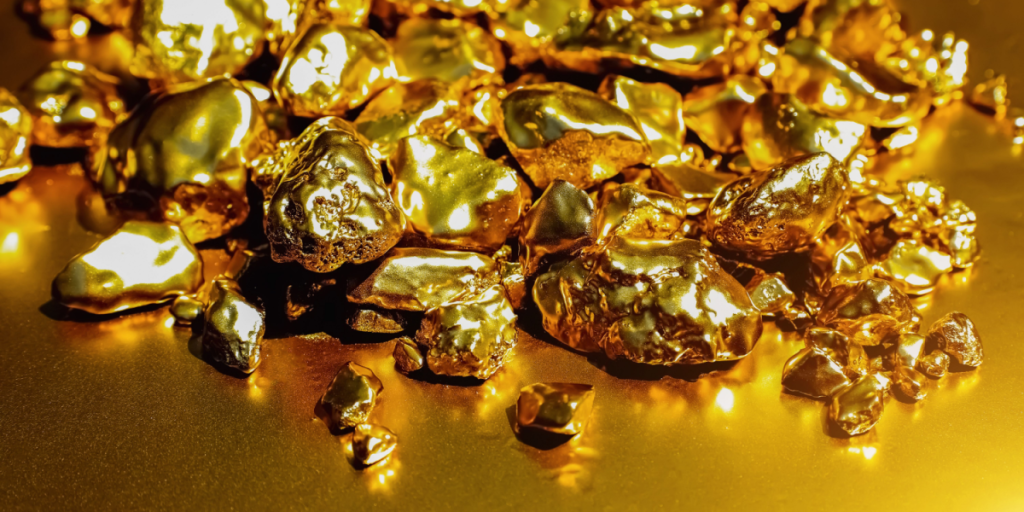

Gold breaks $5,200 barrier

Gold has continued its dramatic climb, hitting a record $5,200 an ounce. The precious metal has soared nearly 90% since Trump’s second inauguration, as investors flock to safe assets amid ongoing political and economic uncertainty.

Also read

All eyes on the Federal Reserve

Markets are bracing for the Federal Reserve’s first interest rate decision of the year. Despite pressure from Trump to slash rates, the central bank is expected to hold them steady, adding another layer of tension to the unfolding financial drama.

Trump’s attacks on Fed stir political unrest

Trump has lashed out at Fed chair Jerome Powell, calling him “stupid” and threatening his removal. The ongoing political interference has sparked concern about the central bank’s independence and its ability to steer monetary policy.

Powell under investigation as term nears end

Adding to the turmoil, the Justice Department has launched a criminal investigation into Powell over renovations to the Fed’s headquarters. His term is set to expire in May, and Trump may soon appoint a successor.

Dollar expected to weaken further

With political instability, rising national debt, and growing pressure on the Federal Reserve, analysts predict the dollar could fall even further. For global markets already on edge, the coming months may bring more uncertainty.